Question: I need the answer for C only , very fast , please help me, I do not have time , I only have 20 minutes

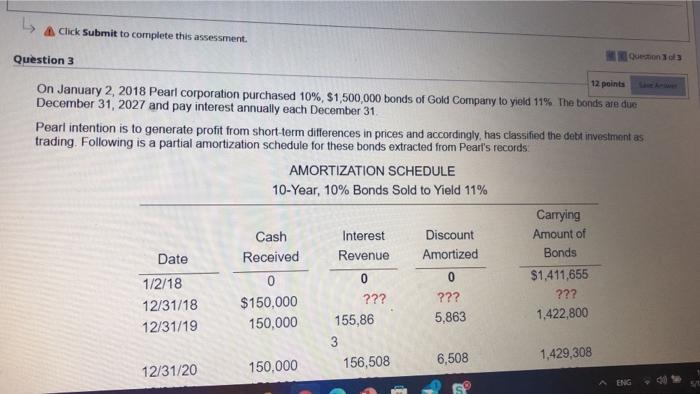

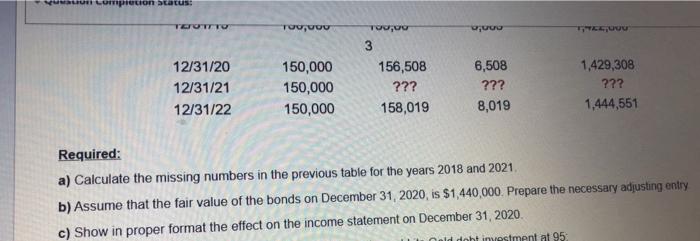

Click Submit to complete this assessment. Question 3 Questions On January 2, 2018 Pearl corporation purchased 10%, $1,500,000 bonds of Gold Company to yield 11% The bonds are due 12 points December 31, 2027 and pay interest annually each December 31 Pearl intention is to generate profit from short-term differences in prices and accordingly, has classified the debt investment as trading. Following is a partial amortization schedule for these bonds extracted from Pearl's records AMORTIZATION SCHEDULE 10-Year, 10% Bonds Sold to Yield 11% Carrying Cash Interest Discount Amount of Date Received Revenue Amortized Bonds 1/2/18 0 0 $1,411,655 12/31/18 $150,000 ??? ??? ??? 12/31/19 150,000 155,86 5,863 1,422,800 0 156,508 6,508 1.429,308 12/31/20 150,000 I Un completion Status: TOOTTO Tovou , w 12/31/20 12/31/21 12/31/22 150,000 150,000 150,000 3 156,508 ??? 158,019 6,508 ??? 8,019 1,429,308 ??? 1,444,551 Required: a) Calculate the missing numbers in the previous table for the years 2018 and 2021 b) Assume that the fair value of the bonds on December 31, 2020, is $1.440,000. Prepare the necessary adjusting entry c) Show in proper format the effect on the income statement on December 31, 2020 Cold doht investment at 95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts