Question: I need the answer please fast Click Submit to complete this assessment. Question 8 A company buys an oil rig for $1,000,000 on January 1,

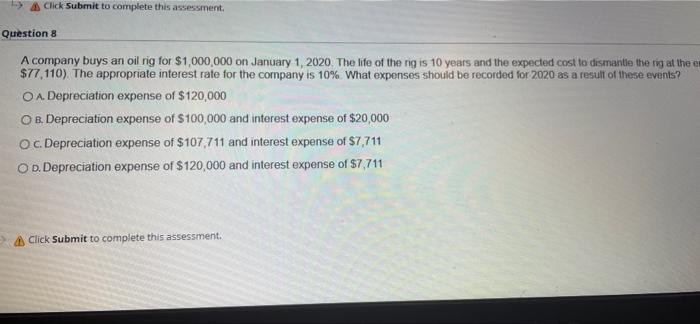

Click Submit to complete this assessment. Question 8 A company buys an oil rig for $1,000,000 on January 1, 2020. The life of the ng is 10 years and the expected cost to dismantle the rig at the en $77,110). The appropriate interest rate for the company is 10% What expenses should be recorded for 2020 as a result of these events? OA. Depreciation expense of $120,000 O B. Depreciation expense of $100,000 and interest expense of $20,000 OC. Depreciation expense of $107,711 and interest expense of $7,711 O D. Depreciation expense of $120,000 and interest expense of $7,711 Click Submit to complete this assessment. Question of a 1 points Save Arower 0. The life of the rig is 10 years and the expected cost to dismantle the rig at the end of 10 years is $200,000 (present value at 10% is 0%. What expenses should be recorded for 2020 as a result of these events? e of $20,000 of $7,711 of $7,711 Question of a Save and Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts