Question: I need the complete and correct solution with all formulas required Question 2: Structured Product Consider an Airbag security, an investment product, offered by SC

I need the complete and correct solution with all formulas required

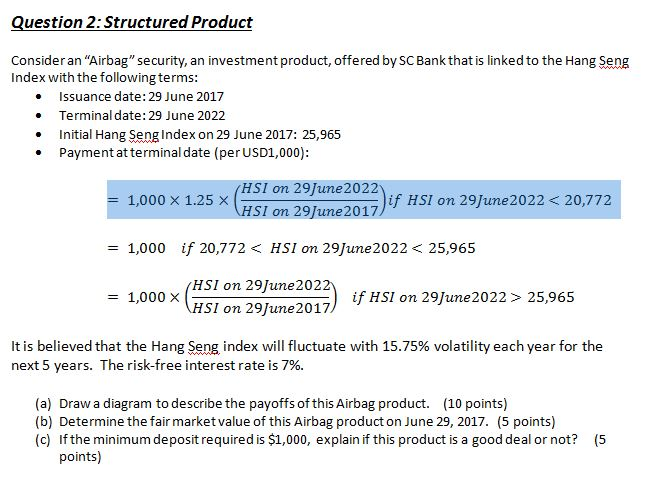

Question 2: Structured Product Consider an "Airbag" security, an investment product, offered by SC Bank that is linked to the Hang Seng Index with the followingterms: Issuance date: 29 June 2017 Terminal date: 29 June 2022 Initial Hang Seng Index on 29 June 2017: 25,965 Payment at terminal date (per USD1,000): . 1,000 1.25 C HSI on 29June2022 HSI on 29June2017 f HSI on 29June2022 25,965 It is believed that the Hang Seng index will fluctuate with 15.75% volatility each year for the next 5 years. The risk-free interest rate is 7%. (a) Draw a diagram to describe the payoffs of this Airbag product. (10 points) (b) Determine the fair market value of this Airbag product on June 29, 2017. (5 points) (c) If the minimum deposit required is $1,000, explain if this product is a good deal or not? (S points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts