Question: I need the solution to solve this problem. Currently the firm has total market value of debt $20 million and total market value of equity

I need the solution to solve this problem.

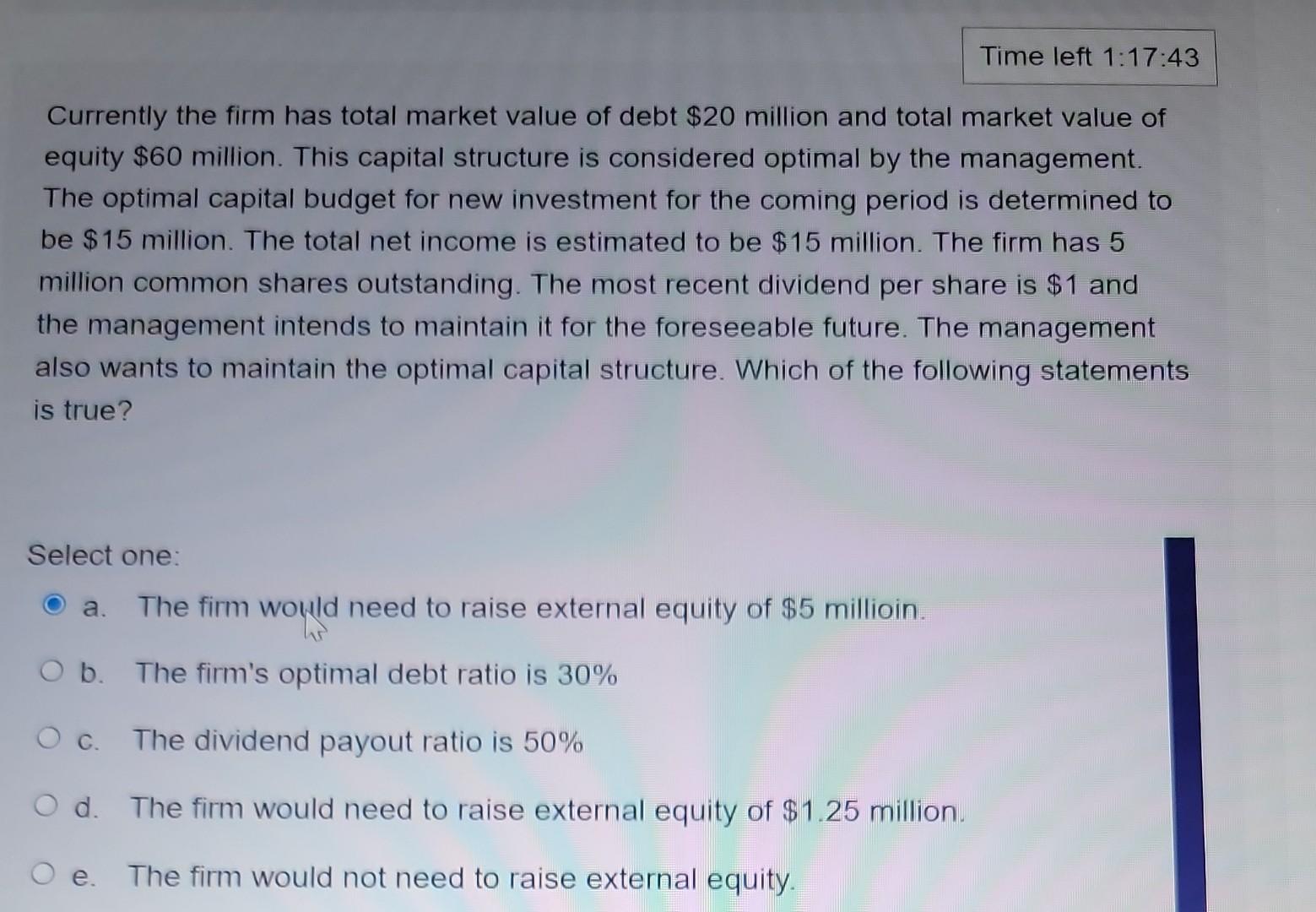

Currently the firm has total market value of debt $20 million and total market value of equity $60 million. This capital structure is considered optimal by the management. The optimal capital budget for new investment for the coming period is determined to be $15 million. The total net income is estimated to be $15 million. The firm has 5 million common shares outstanding. The most recent dividend per share is $1 and the management intends to maintain it for the foreseeable future. The management also wants to maintain the optimal capital structure. Which of the following statements is true? Select one: a. The firm would need to raise external equity of $5 millioin. Time left 1:17:43 O b. The firm's optimal debt ratio is 30% O c. The dividend payout ratio is 50% Od. The firm would need to raise external equity of $1.25 million. Oe. The firm would not need to raise external equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts