Question: i need the solution urgently!. Dr. Muhyiddin, after completing his medical education, established his own practice on May-2016. The following transaction occurred during the first

i need the solution urgently!.

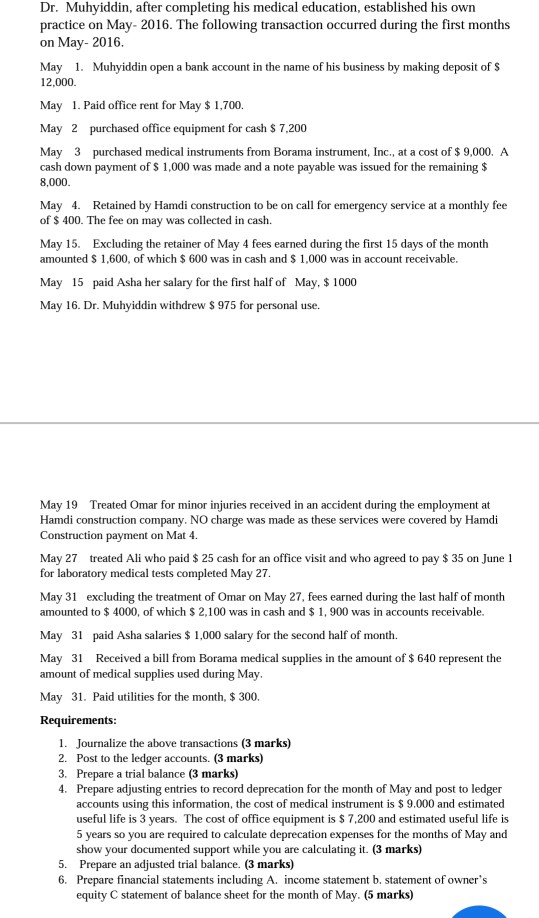

Dr. Muhyiddin, after completing his medical education, established his own practice on May-2016. The following transaction occurred during the first months on May-2016. May 1. Muhyiddin open a bank account in the name of his business by making deposit of $ 12,000 May 1. Paid office rent for May $ 1,700. May 2 purchased office equipment for cash $ 7,200 May 3 purchased medical instruments from Borama instrument, Inc., at a cost of $ 9,000. A cash down payment of $ 1,000 was made and a note payable was issued for the remaining $ 8,000. May 4. Retained by Hamdi construction to be on call for emergency service at a monthly fee of $ 400. The fee on may was collected in cash. May 15. Excluding the retainer of May 4 fees earned during the first 15 days of the month amounted $ 1,600, of which $ 600 was in cash and $ 1,000 was in account receivable. May 15 paid Asha her salary for the first half of May, $ 1000 May 16. Dr. Muhyiddin withdrew $ 975 for personal use. May 19 Treated Omar for minor injuries received in an accident during the employment at Hamdi construction company. NO charge was made as these services were covered by Hamdi Construction payment on Mat 4. May 27 treated Ali who paid $ 25 cash for an office visit and who agreed to pay $ 35 on June 1 for laboratory medical tests completed May 27. May 31 excluding the treatment of Omar on May 27, fees earned during the last half of month amounted to $ 4000, of which $ 2,100 was in cash and $ 1,900 was in accounts receivable. May 31 paid Asha salaries $ 1,000 salary for the second half of month. May 31 Received a bill from Borama medical supplies in the amount of $ 640 represent the amount of medical supplies used during May. May 31. Paid utilities for the month, $ 300. Requirements: 1. Journalize the above transactions (3 marks) 2. Post to the ledger accounts. (3 marks) 3. Prepare a trial balance (3 marks) 4. Prepare adjusting entries to record deprecation for the month of May and post to ledger accounts using this information, the cost of medical instrument is $ 9.000 and estimated useful life is 3 years. The cost of office equipment is $ 7,200 and estimated useful life is 5 years so you are required to calculate deprecation expenses for the months of May and show your documented support while you are calculating it. (3 marks) 5. Prepare an adjusted trial balance. (3 marks) 6. Prepare financial statements including A. income statement b. statement of owner's equity C statement of balance sheet for the month of May

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts