Question: I need the steps for calculating the following problem on a financial calculator (BA II Plus), please. I already have the answers but I specifically

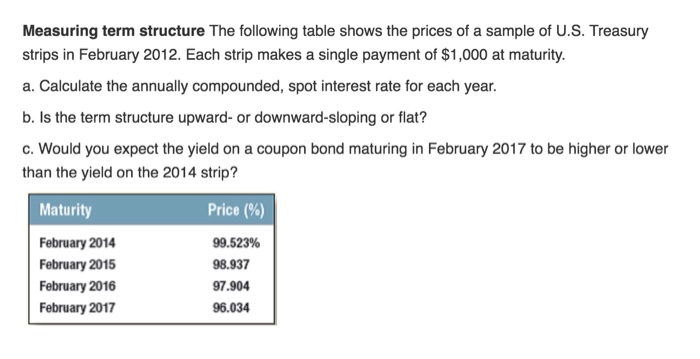

Measuring term structure The following table shows the prices of a sample of U.S. Treasury strips in February 2012. Each strip makes a single payment of $1,000 at maturity. a. Calculate the annually compounded, spot interest rate for each year. b. Is the term structure upward- or downward-sloping or flat? c. Would you expect the yield on a coupon bond maturing in February 2017 to be higher or lower than the yield on the 2014 strip? Price (%) 99.523% 98.937 97.904 96.034 Maturity February 2014 February 2015 February 2016 February 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts