Question: I need the steps for calculating the following problem on a financial calculator (BA II Plus), please. I already have the answers but I specifically

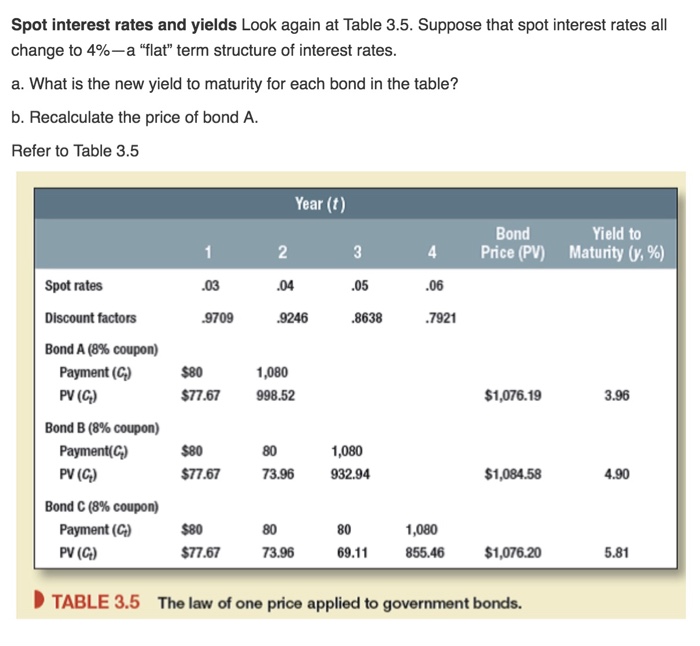

Spot interest rates and yields Look again at Table 3.5. Suppose that spot interest rates all change to 4%-a "flat" term structure of interest rates a. What is the new yield to maturity for each bond in the table? b. Recalculate the price of bond A Refer to Table 3.5 Year (t) 2 .04 9246 Bond Price (PV) Yield to Maturity (y, %) 4 Spot rates Discount factors Bond A (8% coupon) .05 9709 8638 7921 Payment (C) PV (C) $80 77.67 998.52 1,080 $1,076.19 3.96 Bond B (8% coupon) $80 $77.67 80 Payment(C) PV (C) 1,080 932.94 73.96 $1,084.58 4.90 Bond C (8% coupon) Payment (C PV (C) $80 $77.67 80 69.11 1,080 855.46 $1,076.20 80 73.96 5.81 TABLE 3.5 The law of one price applied to government bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts