Question: I need the steps to do this in QuickBooks, I confused with number 1 and 3 SCENARIO BAS just started offering a new service called

I need the steps to do this in QuickBooks, I confused with number 1 and 3

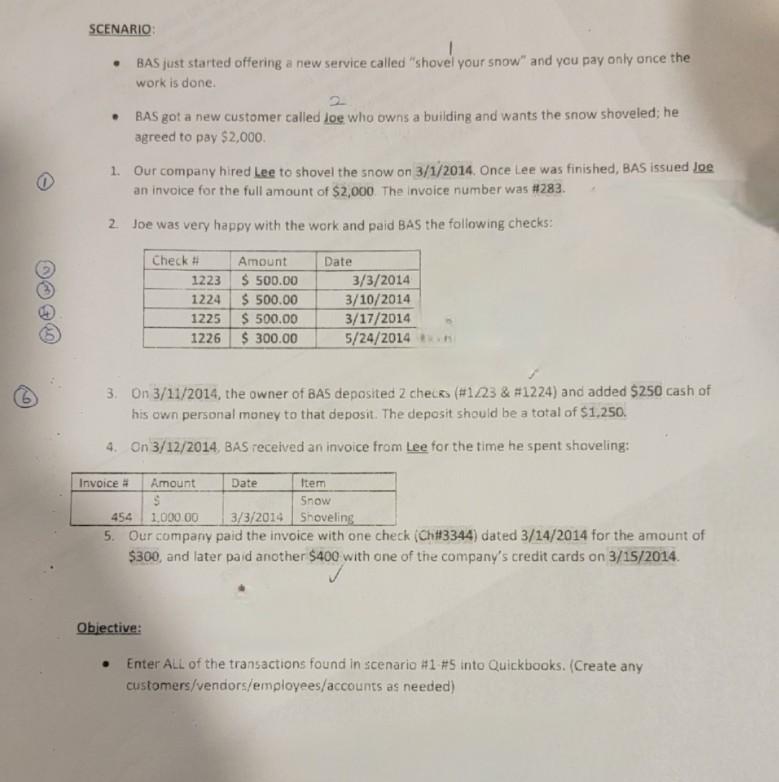

SCENARIO BAS just started offering a new service called "shovel your snow" and you pay only once the work is done 2 BAS got a new customer called Joe who owns a building and wants the snow shoveled; he agreed to pay $2,000 0 1. Our company hired Lee to shovel the snow on 3/1/2014. Once Lee was finished, BAS issued Joe an invoice for the full amount of $2,000. The invoice number was #282. 2. Joe was very happy with the work and paid BAS the following checks: Check # 1223 1224 1225 1226 Amount $ 500.00 $ 500.00 $ 500.00 $ 300.00 Date 3/3/2014 3/10/2014 3/17/2014 5/24/2014 3. On 3/11/2014, the owner of BAS deposited 2 checks (#1223 & #1224) and added $250 cash of his own personal money to that deposit. The deposit should be a total of $1,250. a 4. On 3/12/2014, BAS received an invoice from Lee for the time he spent shoveling: Invoice Amount Date Item Snow 454 1.000.00 3/3/2014 Shoveling 5. Our company paid the invoice with one check (Ch#3344) dated 3/24/2014 for the amount of $300, and later paid another $400 with one of the company's credit cards on 3/15/2014 Obiective: Enter ALL of the transactions found in scenario #1 #5 into Quickbooks. (Create any customers/vendors/employees/accounts as needed) SCENARIO BAS just started offering a new service called "shovel your snow" and you pay only once the work is done 2 BAS got a new customer called Joe who owns a building and wants the snow shoveled; he agreed to pay $2,000 0 1. Our company hired Lee to shovel the snow on 3/1/2014. Once Lee was finished, BAS issued Joe an invoice for the full amount of $2,000. The invoice number was #282. 2. Joe was very happy with the work and paid BAS the following checks: Check # 1223 1224 1225 1226 Amount $ 500.00 $ 500.00 $ 500.00 $ 300.00 Date 3/3/2014 3/10/2014 3/17/2014 5/24/2014 3. On 3/11/2014, the owner of BAS deposited 2 checks (#1223 & #1224) and added $250 cash of his own personal money to that deposit. The deposit should be a total of $1,250. a 4. On 3/12/2014, BAS received an invoice from Lee for the time he spent shoveling: Invoice Amount Date Item Snow 454 1.000.00 3/3/2014 Shoveling 5. Our company paid the invoice with one check (Ch#3344) dated 3/24/2014 for the amount of $300, and later paid another $400 with one of the company's credit cards on 3/15/2014 Obiective: Enter ALL of the transactions found in scenario #1 #5 into Quickbooks. (Create any customers/vendors/employees/accounts as needed)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts