Question: This is my 3rd time posting this question. PLEASE TYPE answers, hand writing on this app is rarely legible. PLEASE answer ALL parts. It is

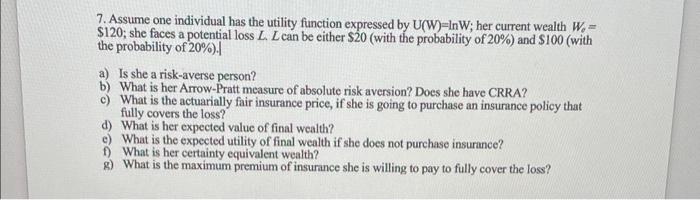

7. Assume one individual has the utility function expressed by U(W)-InW; her current wealth W.- $120; she faces a potential loss L. L can be either $20 (with the probability of 20%) and $100 (with the probability of 20%). a) Is she a risk-averse person? b) What is her Arrow-Pratt measure of absolute risk aversion? Does she have CRRA? c) What is the actuarially fair insurance price, if she is going to purchase an insurance policy that fully covers the loss? d) What is her expected value of final wealth? c) What is the expected utility of final wealth if she does not purchase insurance? f) What is her certainty equivalent wealth? g) What is the maximum premium of insurance she is willing to pay to fully cover the loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts