Question: I news help understand this question. I have the solution, but still need help. Please and thank you! solution You can choose to invest into

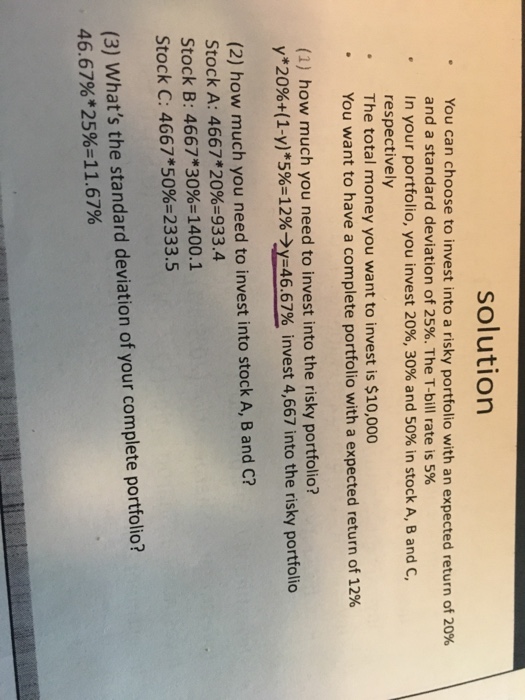

solution You can choose to invest into a risky portfolio with an expected return of 20% and a standard deviation of 25%. The T-bill rate is 5% In your portfolio, you invest 20%, 30% and 50% in stock A, B and C, respectively The total money you want to invest is $10,000 You want to have a complete portfolio with a expected return of 12% (1) how much you need to invest into the risky portfolio? y *20%+( 1-y) *596-129 y-46.67% nvest 4,667 into the risky portfolio (2) how much you need to invest into stock A, B and C? Stock A: 4667*20%-933.4 Stock B: 4667*30%-1400.1 Stock C: 4667*50%-2333.5 (3) What's the standard deviation of your complete portfolio? 46.67% *2596-11.67%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts