Question: I only need help with B. Notice A. has been answered and is correct. HINT I did the math for B and the answer is

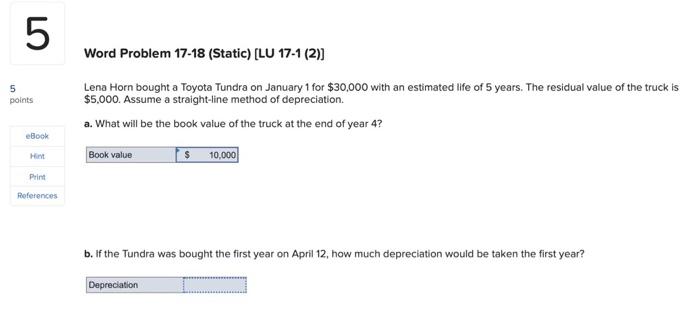

5 Word Problem 17-18 (Static) [LU 17-1 (2)] 5 points Lena Horn bought a Toyota Tundra on January 1 for $30,000 with an estimated life of 5 years. The residual value of the truck is $5.000. Assume a straight-line method of depreciation a. What will be the book value of the truck at the end of year 4? eBook Hint Book value $ 10,000 Print References b. If the Tundra was bought the first year on April 12, how much depreciation would be taken the first year? Depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts