Question: I primarily need help on (b) Instructions On the first day of its fiscal year. Ebert Company issued $50,000,000 of 10-year, 7% bonds to finance

I primarily need help on (b)

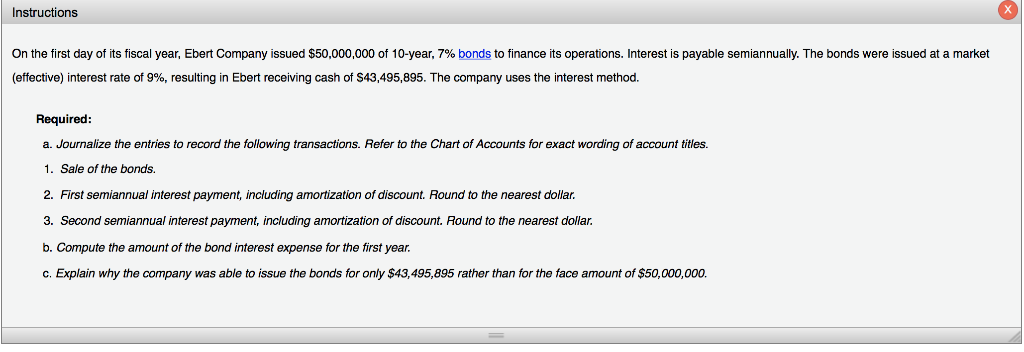

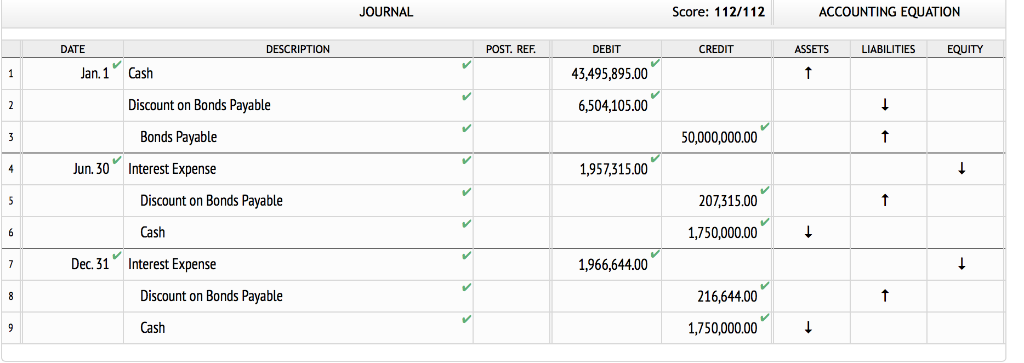

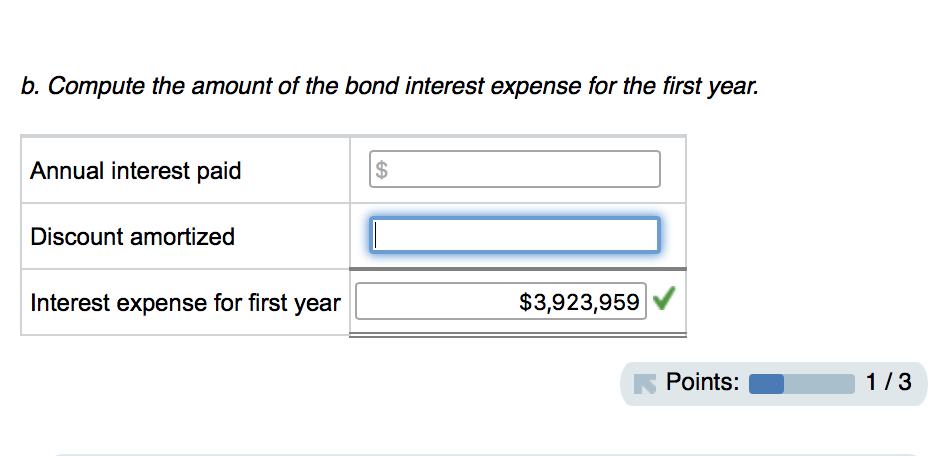

Instructions On the first day of its fiscal year. Ebert Company issued $50,000,000 of 10-year, 7% bonds to finance its operations Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 9%, resulting in Ebert receiving cash of S43495,895. The company uses the interest method. Required a. Journalize the entries to record the following transactions. Refer to the Chart of Accounts for exact wording of account titles. 1. Sale of the bonds. 2. First semiannual interest payment, including amortization of discount. Round to the nearest dollar. 3. Second semiannual interest payment, including amortization of discount. Round to the nearest dollar. b. Compute the amount of the bond interest expense for the first year. c. Explain why the company was able to issue the bonds for only $43,495,895 rather than for the face amount of $50,000,000. JOURNAL Score: 112/112 ACCOUNTING EQUATION DESCRIPTION DATE POST. REF DEBIT 43,495,895.00 6,504,105.00 CREDIT ASSETS LIABILITIES EQUITY Jan. 1 Cash Discount on Bonds Payable 0,000,000.00 Bonds Payable Jun. 30Interest Expense 1,957,315.00 207,315.00 Discount on Bonds Payable Cash 1,750,000.00 Dec. 31 Interest Expense 1,966,644.00 Discount on Bonds Payable 216,644.00 Cash 1,750,000.00 b. Compute the amount of the bond interest expense for the first year. Annual interest paid Discount amortized $3,923,959 Interest expense for first year Points: 1/3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts