Question: I really need help. I tried the question multiple times and still cant get it right. LakeCratt is considering investing in a cruse stip with

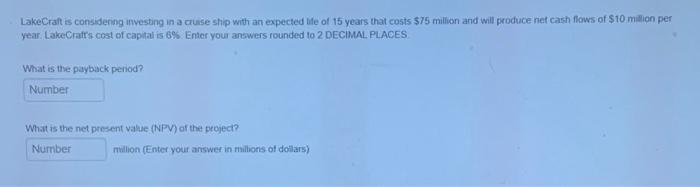

LakeCratt is considering investing in a cruse stip with an expected life of 15 years that costs $75 million and will produce net cash flows of $10 mition per year. Lake-Crafts cost of captat is 6%. Enter you anewers rounded to 2 DECIMAL. PLACES What is the paybiack penod? What is the net present value (NPV) of the project? mulion (Enter vour answer in milhans of dollars) LakeCratt is considering investing in a cruse stip with an expected life of 15 years that costs $75 million and will produce net cash flows of $10 mition per year. Lake-Crafts cost of captat is 6%. Enter you anewers rounded to 2 DECIMAL. PLACES What is the paybiack penod? What is the net present value (NPV) of the project? mulion (Enter vour answer in milhans of dollars)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts