Question: I tried these values and it didnt work need help now. I have few days to work on it so i am not in rush.

I tried these values and it didnt work need help now. I have few days to work on it so i am not in rush. Thanks

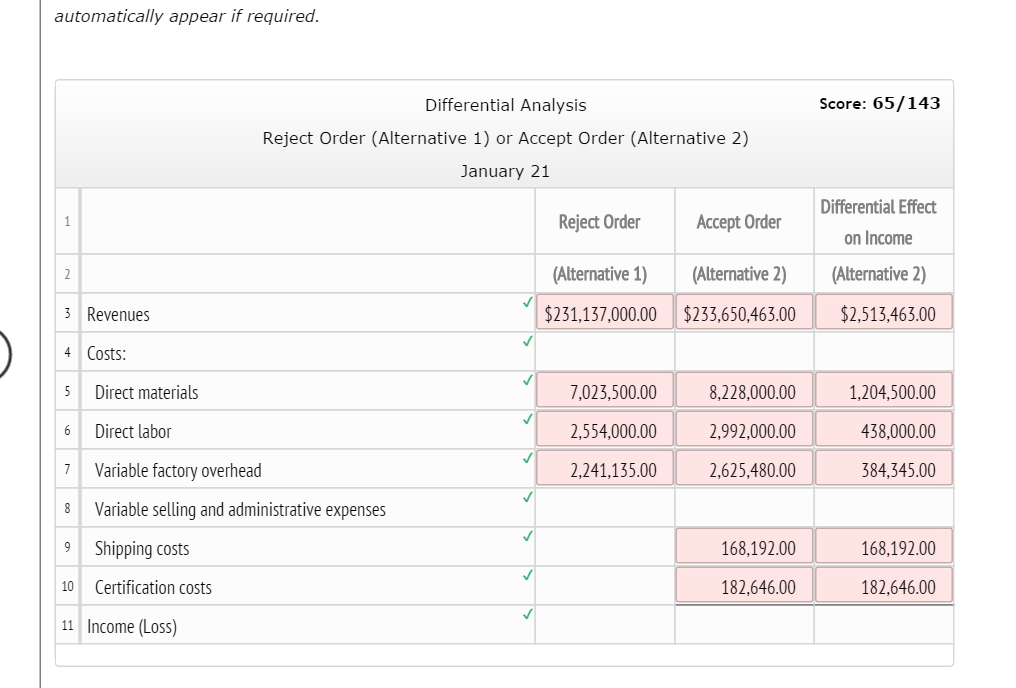

Brightstone Tire and Rubber Company has capacity to produce 194,000 tires. Brightstone presently produces and sells 134,900 tires for the North American market at a price of $180 per tire. Brightstone is evaluating a special order from a European automobile company, Euro Motors. Euro is offering to buy 19,400 tires for $115.60 per tire. Brightstones accounting system indicates that the total cost per tire is as follows:

| Direct materials | $57 |

| Direct labor | 20 |

| Factory overhead (57% variable) | 26 |

| Selling and administrative expenses (46% variable) | 26 |

| Total | $129.00 |

Brightstone pays a selling commission equal to 4% of the selling price on North American orders, which is included in the variable portion of the selling and administrative expenses. However, this special order would not have a sales commission. If the order was accepted, the tires would be shipped overseas for an additional shipping cost of $7.01 per tire. In addition, Euro has made the order conditional on receiving European safety certification. Brightstone estimates that this certification would cost $162,184.

| Required: | ||||||||||||||||||||||||||||

| A. | Prepare a differential analysis dated January 21 on whether to reject (Alternative 1) or accept (Alternative 2) the special order from Euro Motors. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If there is no amount or an amount is zero, enter "0". A colon (:) will automatically appear if required. | |||||||||||||||||||||||||||

| B. | Determine whether the company should reject (Alternative 1) or accept (Alternative 2) the special order from Euro Motors | |||||||||||||||||||||||||||

| C. | What is the minimum price per unit that would be financially acceptable to Brightstone?

|

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts