Question: I. True or false? Briefly do explain. (20%) (a) MM's proposition assumes that increased borrowing does not affect the interest rate on the firm's debt.

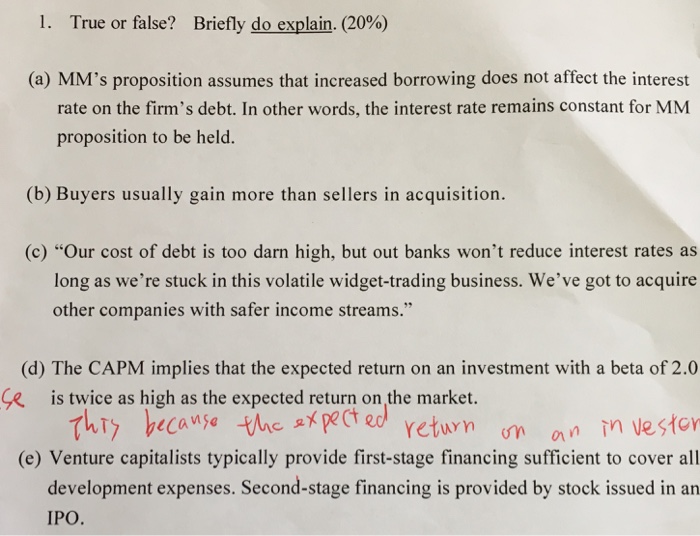

I. True or false? Briefly do explain. (20%) (a) MM's proposition assumes that increased borrowing does not affect the interest rate on the firm's debt. In other words, the interest rate remains constant for MM proposition to be held. (b) Buyers usually gain more than sellers in acquisition. (c) "Our cost of debt is too darn high, but out banks won't reduce interest rates as long as we're stuck in this volatile widget-trading business. We've got to acquire other companies with safer income streams." (d) The CAPM implies that the expected return on an investment with a beta of 2.0 7hT) because HacBXpe(t ed return on an m vester development expenses. Second-stage financing is provided by stock issued in an e is twice as high as the expected return on the market. (e) Venture capitalists typically provide first-stage financing sufficient to cover all IPO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts