Question: I want to know how to answer this question Below are the quarterly returns on investment (in 2000s) of two different investment projects which had

I want to know how to answer this question

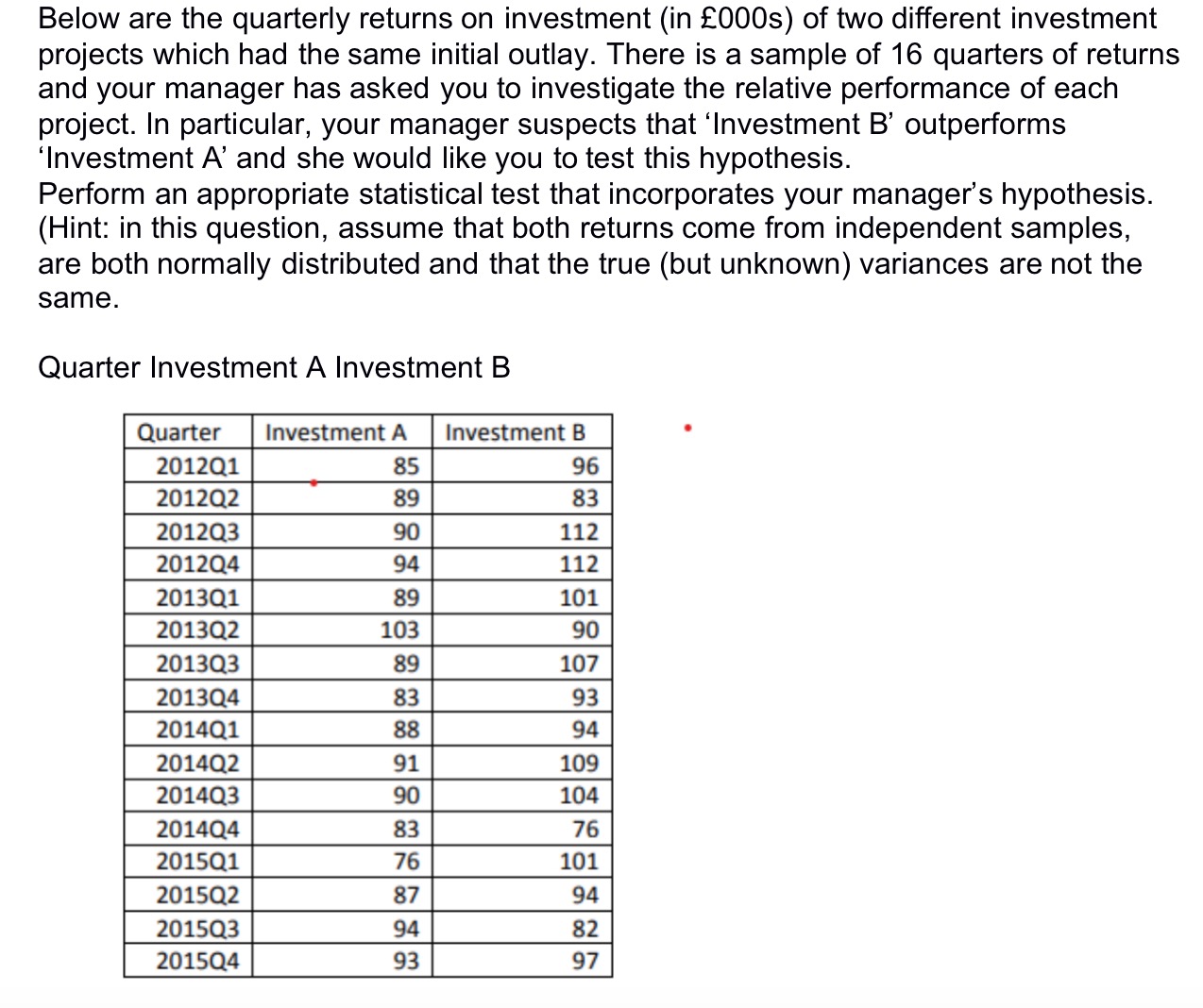

Below are the quarterly returns on investment (in 2000s) of two different investment projects which had the same initial outlay. There is a sample of 16 quarters of returns and your manager has asked you to investigate the relative performance of each project. In particular, your manager suspects that 'Investment B' outperforms Investment A' and she would like you to test this hypothesis. Perform an appropriate statistical test that incorporates your manager's hypothesis. (Hint: in this question, assume that both returns come from independent samples, are both normally distributed and that the true (but unknown) variances are not the same. Quarter Investment A Investment B Quarter Investment A Investment B 2012Q1 85 96 2012Q2 89 83 2012Q3 90 112 2012Q4 94 112 2013Q1 89 101 2013Q2 103 90 2013Q3 89 107 2013Q4 83 93 2014Q1 88 94 201402 91 109 2014Q3 90 104 2014Q4 83 76 2015Q1 76 101 2015Q2 87 94 2015Q3 94 82 2015Q4 93 97

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts