Question: I want you to explain the answer please Use a 2 step binomial tree with two steps to price a European 1 year put on

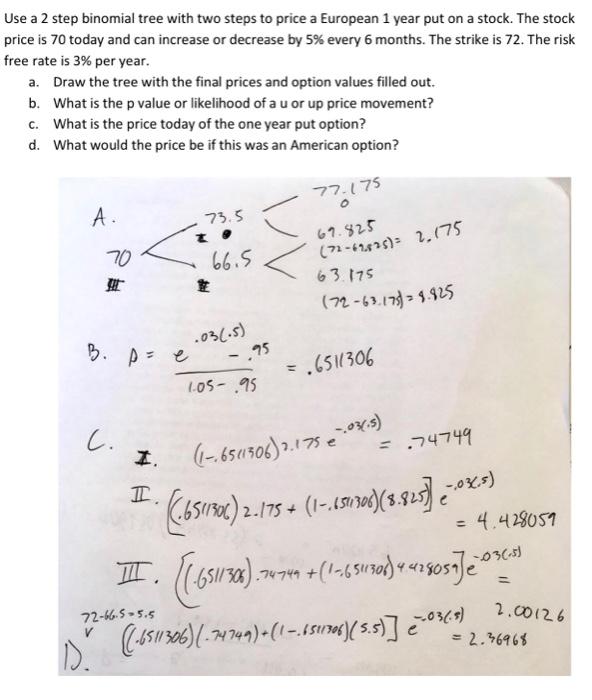

Use a 2 step binomial tree with two steps to price a European 1 year put on a stock. The stock price is 70 today and can increase or decrease by 5% every 6 months. The strike is 72. The risk free rate is 3% per year. a. Draw the tree with the final prices and option values filled out. b. What is the p value or likelihood of a u or up price movement? C. What is the price today of the one year put option? d. What would the price be if this was an American option? 77.175 A. 73.5 67.825 (72-69525) 2.075 70 66.5 63.175 (72-63.175) = 8.925 B. p= e .031.5) -,95 = .6511306 1.05 - .95 C. = .74749 I (12.650306) 2.178 04:) I. 2.175+ (1-65170(8.825) 2-0% )) = 4.428057 -036-5) 6651390. ) 2. 15. ( susa. ).74740 + (1-65930)44150597203 (151305)(-4749)+ (1151706)( 5.5)] 23-0367 72-66.5-5.5 2.00126 = 2.36968 Use a 2 step binomial tree with two steps to price a European 1 year put on a stock. The stock price is 70 today and can increase or decrease by 5% every 6 months. The strike is 72. The risk free rate is 3% per year. a. Draw the tree with the final prices and option values filled out. b. What is the p value or likelihood of a u or up price movement? C. What is the price today of the one year put option? d. What would the price be if this was an American option? 77.175 A. 73.5 67.825 (72-69525) 2.075 70 66.5 63.175 (72-63.175) = 8.925 B. p= e .031.5) -,95 = .6511306 1.05 - .95 C. = .74749 I (12.650306) 2.178 04:) I. 2.175+ (1-65170(8.825) 2-0% )) = 4.428057 -036-5) 6651390. ) 2. 15. ( susa. ).74740 + (1-65930)44150597203 (151305)(-4749)+ (1151706)( 5.5)] 23-0367 72-66.5-5.5 2.00126 = 2.36968

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts