Question: I was strugguling on section f. can you work it put for me please. on paper or on excel woild be fine. thank you You

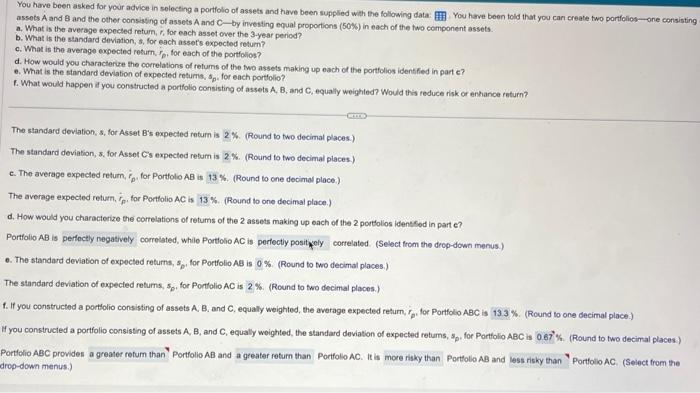

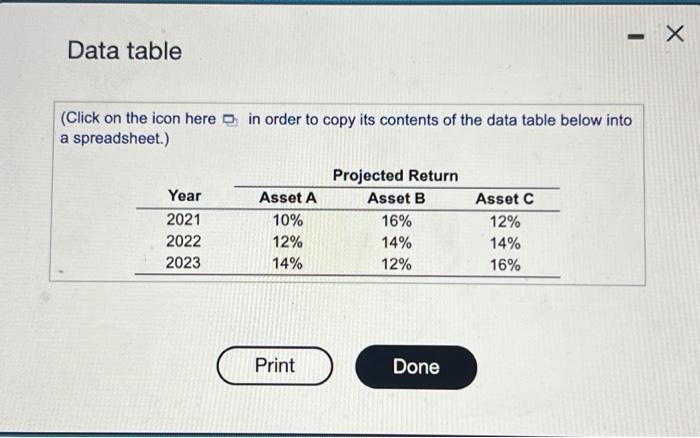

You have been asked for your advice in solecting a portfolo of assets and have been supplied with the following data: assots A and B and the other consiasing of assets A and C - by investing equal proportions (50\%) in eas of the two c a. What is the average expected return, , for each asget over the 3 -year pericut? b. What is the standard deviation, s, for each asser's expocted return? c. What is the average expected return, rp, for each of the portfolios? d. How would you characterize the correlations of retums of the two assets making up each of the portfolios idensfied in part c ? e. What is the standard deviation of expected returns, sp. for each portfolio? 1. What would happen if you constructed a portfolio consisting of assets A,B, and C, equally weighted? Would this reduce risk or enhance return? The standard deviation, s, for Asset B's expected return is 2%. (Round to two decimal places) The standard deviation, s, for Asset Cs expected retum is 2%. (Round to two decimal places.) c. The averape expected return, ip, for Portolio AB is 13%. (Round to one decimal place) The average expected return, rp, for Portilolio AC is 13%. (Round to one decimal place.) d. How would you characterize the correlations of retums of the 2 assets making up each of the 2 portolios idenesed in part C ? Portfolio AB is correlated, while Portlolio AC is correlated. (Select from the drop-down menus) 6. The standard deviation of expected returns, sp, for Portfolio AB is 0%. (Round to two decimal places.) The standard deviation of expected retums, sp, for Portiolio AC is 2%. (Round to two decimal places.) 1. If you constructed a portholio consisting of assets A,B, and C, equally weighted, the average expected return, rp, for Portfolo ABC is (Round to one decimal place.) fyou constructed a portfolio consisting of assets A, B, and C, equally woighted, the standard doviation of expocted retums, sp. for Portfolio ABC is (Round to two decimal places) Portiolio ABC provides Irop-down menus.) Portiolio AB and Portfolio AC. It is Portlolio AB and Portiolio AC. (Select from the Data table (Click on the icon here in order to copy its contents of the data table below into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts