Question: I will appreciate your efforts in solving this question (: company that produces motors for specialized equipment sold primarily to resears defense contractor. The operation

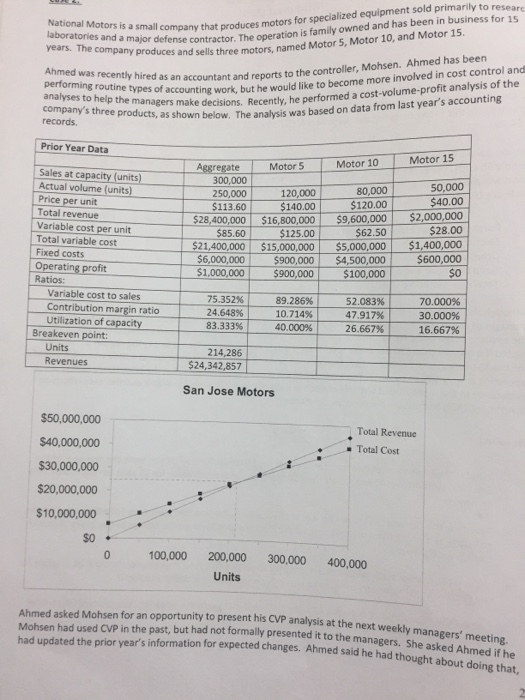

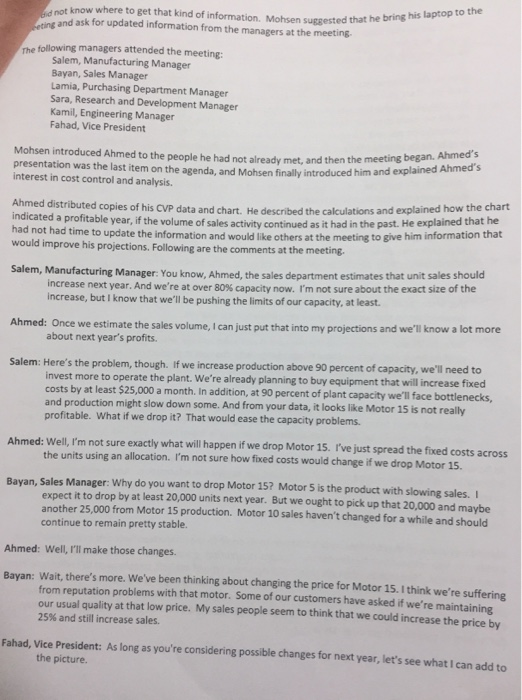

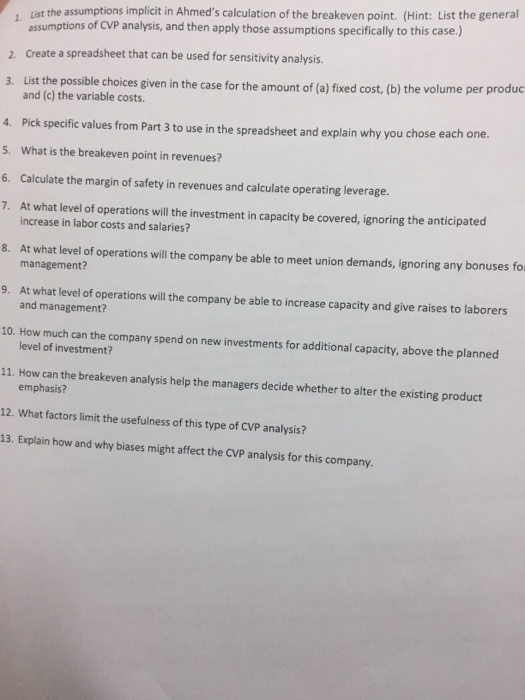

company that produces motors for specialized equipment sold primarily to resears defense contractor. The operation is family owned and has been in business for 15 National Motors is a small company pr contractor. and sells three motors, named Motor 5, Motor 10, and Motor 15 laboratories and as laboratories and a major Ahmed an accountant and reports to the controller, Mohsen. Ahmed has been counting work, but he would like to become more involved in cost control and analyses to help the managers make Rece company's three products, as shown below. The analysis was records Recently, he performed a cost-volume-profit analysis of the decisions, based on data from last year's accounting Prior Year Data Aggregate Motor 5 Motor 10Motor 15 Sales at capacity (units) Actual volume (units) Price per unit Total revenue Variable cost per unit Total variable cost Fixed costs Operating profit Ratios: 300,000 250,000 $113.60 50,000 80,000 50$140.00 $120.00 $62.50 $6,000,000 $900,000 4,500,000 120,000 $28,400,000 $16,800,000 $9,600,000 $2,000,000 $21,400,000 15,000,000 $5.000,000 $1,400,000 $28.00 $85.60 $125.00 $600,000 $0 $1,000,000 $900,000 $100,000 Variable cost to sales 75.352%| 24.648% 83.333% 89.286%| 10.714% 40.000% 52.083% 47.917% 26.667% | 70.000% 30.000% 16.667% Contribution margin ratio Utilization of capacity Breakeven point: Units Revenues 214,286 $24,342,857 San Jose Motors $50,000,000 $40,000,000 $30,000,000 $20,000,000 $10,000,000 Total Revenue Total Cost So 100,000 200,000 300,000 400,000 Units sonportunity to present his CVP analysis at the next weekly managers' meeting. oast but had not formally presented it to the managers. She asked Ahmed if he Mohsen had used CVP in the had updated the prior year's information for expected changes. Ahmed said he had thought about doing that, not know where to get that kind of information. Mohsen suggested and ask for updated information from the managers at the meeting that he bring his laptop to the following managers attended the meeting Salem, Manufacturing Manager Bayan, Sales Manager Lamia, Purchasing Department Manager Sara, Research and Development Manager Kamil, Engineering Manager Fahad, Vice President meeting began. Ahmed's and explained Ahmed's Mohsen introduced Ahmed to the people he had not already met, and then the presentation was the last item on the agenda, and Mohsen finally introduced him interest in cost control and analysis. Ahmed distributed copies of his CVP data and chart. He described the calculations and explained how the chart indic ated a profitable year, if the volume of sales activity continued as it had in the past. He explained that he had not had time to update the information and would like others at the meeting to give would improve his projections. Following are the comments at the meeting him information that Salem, Manufacturing Manager: You know, Ahmed, the sales department estimates that unit sales should increase next year. And we're at over 80% capacity now. I'm not sure about the exact size of the increase, but I know that we'll be pushing the limits of our capacity, at least. we estimate the sales volume, I can just put that into my projections and we'll know a lot more Ahmed: Once about next year's profits Here's the problem, though. If we increase production above 90 percent of capacity, we'll need to invest more to operate the plant. We're already planning to buy equipment that will increase fixed costs by at least $25,000 a month. In addition, 90 and production might slow down some. And from your data, it looks like Motor 15 is not really profitable. What if we drop it? That would ease the capacity problems Salem: on, at 90 percent of plant capacity we'll face bottlenecks d: Well,I'm not sure exactly what will happen if we drop Motor 15. I've just spread the fixed costs across how fixed costs would change if we drop Motor 15. the units using an allocation. I'm not sure Bayan, Sales Manager: Why do you want to drop Motor 15? Motor 5 is the product with slowing sales. expect it to drop by at least 20,000 units next year. But we ought to pick up that 20,000 and maybe another 25,000 from Motor 15 production. Motor 10 sales haven't changed for a while and should continue to remain pretty stable. Ahmed: Well, I'll make those changes. Bayan: Wait, there's more. We've been thinking about changing the price for Motor 15. I think we're suffering from reputation problems with that motor. Some of our customers have asked if we're maintaining our usual quality at that low price. My sales people seem to think that we could increase the price by 25% and still increase sales. Fahad, Vice President: As long as you're considering possible changes for next year, let's see what I can add to the picture t considered here, we always give the government about 30% of for reinvestment. We've got to buy that , it seems that taxes aren' profits. And then we'll need to keep some money back equipment to increase capacity, and that will require ano ther $500,000, at least. will probably increase by at Second, the union wants a raise for the production crew. Our variable costs ine need to revisit the way that we give bonuses to the sales force. They get their salaries, plus ission per unit based on price. Maybe we should base their bonus on the contribution margin 5% if we give those people an increase, we'd better be thinking about raises for management, mau e te usually sbive bonuses based on profits and set aside maybe $500,000 for that. In addition, theyo which nstead of sales. Third, I guess it's time to change our product emphasis. No one seems to know which motor is most profitable. The sales staff are just responding to demand and not really pushing any of our motors. Right now Motor 5 is still covering its costs, but if we produce more of Motor 15, it's likely that Motor 5 will become a loser for us. Maybe it's time that we drop it. Can you incorporate these changes right now? nks, Fahad. I thought we'd get a good discussion going about future plans once Ahmed made his presentation. This CVP approach is something that we haven't used before, but as you can see, you've got information to share. Ahmed will need some time to rework his analysis with this new information, but I'm sure he can get a revision out to us by tomorrow morning. It seems that Ahmed's presentation is based on some important assumptions. Most of the questions that were raised were really about those assumptions. It might help us all if Ahmed lists those assumptions so that we can see how they influence the analysis. Then, he'll have to incorporate the increase in unit sales and see what's going on with individual product lines. Also, let's see how things change with changes in product mix, and we may want to drop Motor 5. Ahmed will have to incorporate price changes and consider taxes, investment, and raises. Then he can look at the effect of product emphasis. That should about do it. Once we get Ahmed's revised analysis, we can all take a look at the numbers and think about them for a few days. We'll meet again next week. Ahmed can bring the laptop, and we can do some "what if" analysis on the spot. As he was leaving, Salem said, "Ahmed, before we meet next time, go down to the production floor and get information. It's a waste of time for all of us to meet just to give you information. And send the CVP out ahead so we can think more about changes that could occur next year. Also, bring a computer projector so we can all see how any changes affect overall results, then we can make plans for the next period with better information, and we'll not be caught off guard so often. Ahmed was annoyed that Mohsen hadn't told him to go down to the production floor and over to marketing earlier. He also realized that he should have thought about bringing a projector. When he asked Mohsern about it, he said, "Sometimes when we're introducing a new type of analysis, people need to understand how important their information is to us. Today several people contributed important pieces of information that affect the accuracy of our results. Next time you go out to ask for it, they'll know that they need to give us their best estimates. Otherwise, they might just give us something off the top of their heads because they don't want to take time from other tasks List the assumptions implicit in Ahmed's calculation of the breakeven point. (Hint: List the general , assumptions of CVP analysis, and then apply those assumptions specifically to this case.) Create a spreadsheet that can be used for sensitivity analysis. 2. list the possible cho ices given in the case for the amount of (a) fixed cost, (b) the volume per produc 3. and (c) the variable costs. 4. Pick specific values from Part 3 to use in the spreadsheet and explain why you chose each one. 5. What is the breakeven point in revenues? 6. Calculate the margin of safety in revenues and calculate operating leverage. 7. At what level of operations will the investment in capacity be covered, ignoring the anticipated increase in labor costs and salaries? At what level of operations will the company be able to meet union demands, ignoring any bonuses fo management? 8. At what level of operations will the company be able to increase capacity and give raises to laborers and management? 9. 10. How much can the company spend on new investments for additional capacity, above the planned 11. How can the breakeven analysis help the managers decide whether to alter the existing product 12. What factors limit the usefulness of this type of CVP analysis? 13. Explain how and why biases might affect the CVP analysis for this company. level of investment? emphasis? company that produces motors for specialized equipment sold primarily to resears defense contractor. The operation is family owned and has been in business for 15 National Motors is a small company pr contractor. and sells three motors, named Motor 5, Motor 10, and Motor 15 laboratories and as laboratories and a major Ahmed an accountant and reports to the controller, Mohsen. Ahmed has been counting work, but he would like to become more involved in cost control and analyses to help the managers make Rece company's three products, as shown below. The analysis was records Recently, he performed a cost-volume-profit analysis of the decisions, based on data from last year's accounting Prior Year Data Aggregate Motor 5 Motor 10Motor 15 Sales at capacity (units) Actual volume (units) Price per unit Total revenue Variable cost per unit Total variable cost Fixed costs Operating profit Ratios: 300,000 250,000 $113.60 50,000 80,000 50$140.00 $120.00 $62.50 $6,000,000 $900,000 4,500,000 120,000 $28,400,000 $16,800,000 $9,600,000 $2,000,000 $21,400,000 15,000,000 $5.000,000 $1,400,000 $28.00 $85.60 $125.00 $600,000 $0 $1,000,000 $900,000 $100,000 Variable cost to sales 75.352%| 24.648% 83.333% 89.286%| 10.714% 40.000% 52.083% 47.917% 26.667% | 70.000% 30.000% 16.667% Contribution margin ratio Utilization of capacity Breakeven point: Units Revenues 214,286 $24,342,857 San Jose Motors $50,000,000 $40,000,000 $30,000,000 $20,000,000 $10,000,000 Total Revenue Total Cost So 100,000 200,000 300,000 400,000 Units sonportunity to present his CVP analysis at the next weekly managers' meeting. oast but had not formally presented it to the managers. She asked Ahmed if he Mohsen had used CVP in the had updated the prior year's information for expected changes. Ahmed said he had thought about doing that, not know where to get that kind of information. Mohsen suggested and ask for updated information from the managers at the meeting that he bring his laptop to the following managers attended the meeting Salem, Manufacturing Manager Bayan, Sales Manager Lamia, Purchasing Department Manager Sara, Research and Development Manager Kamil, Engineering Manager Fahad, Vice President meeting began. Ahmed's and explained Ahmed's Mohsen introduced Ahmed to the people he had not already met, and then the presentation was the last item on the agenda, and Mohsen finally introduced him interest in cost control and analysis. Ahmed distributed copies of his CVP data and chart. He described the calculations and explained how the chart indic ated a profitable year, if the volume of sales activity continued as it had in the past. He explained that he had not had time to update the information and would like others at the meeting to give would improve his projections. Following are the comments at the meeting him information that Salem, Manufacturing Manager: You know, Ahmed, the sales department estimates that unit sales should increase next year. And we're at over 80% capacity now. I'm not sure about the exact size of the increase, but I know that we'll be pushing the limits of our capacity, at least. we estimate the sales volume, I can just put that into my projections and we'll know a lot more Ahmed: Once about next year's profits Here's the problem, though. If we increase production above 90 percent of capacity, we'll need to invest more to operate the plant. We're already planning to buy equipment that will increase fixed costs by at least $25,000 a month. In addition, 90 and production might slow down some. And from your data, it looks like Motor 15 is not really profitable. What if we drop it? That would ease the capacity problems Salem: on, at 90 percent of plant capacity we'll face bottlenecks d: Well,I'm not sure exactly what will happen if we drop Motor 15. I've just spread the fixed costs across how fixed costs would change if we drop Motor 15. the units using an allocation. I'm not sure Bayan, Sales Manager: Why do you want to drop Motor 15? Motor 5 is the product with slowing sales. expect it to drop by at least 20,000 units next year. But we ought to pick up that 20,000 and maybe another 25,000 from Motor 15 production. Motor 10 sales haven't changed for a while and should continue to remain pretty stable. Ahmed: Well, I'll make those changes. Bayan: Wait, there's more. We've been thinking about changing the price for Motor 15. I think we're suffering from reputation problems with that motor. Some of our customers have asked if we're maintaining our usual quality at that low price. My sales people seem to think that we could increase the price by 25% and still increase sales. Fahad, Vice President: As long as you're considering possible changes for next year, let's see what I can add to the picture t considered here, we always give the government about 30% of for reinvestment. We've got to buy that , it seems that taxes aren' profits. And then we'll need to keep some money back equipment to increase capacity, and that will require ano ther $500,000, at least. will probably increase by at Second, the union wants a raise for the production crew. Our variable costs ine need to revisit the way that we give bonuses to the sales force. They get their salaries, plus ission per unit based on price. Maybe we should base their bonus on the contribution margin 5% if we give those people an increase, we'd better be thinking about raises for management, mau e te usually sbive bonuses based on profits and set aside maybe $500,000 for that. In addition, theyo which nstead of sales. Third, I guess it's time to change our product emphasis. No one seems to know which motor is most profitable. The sales staff are just responding to demand and not really pushing any of our motors. Right now Motor 5 is still covering its costs, but if we produce more of Motor 15, it's likely that Motor 5 will become a loser for us. Maybe it's time that we drop it. Can you incorporate these changes right now? nks, Fahad. I thought we'd get a good discussion going about future plans once Ahmed made his presentation. This CVP approach is something that we haven't used before, but as you can see, you've got information to share. Ahmed will need some time to rework his analysis with this new information, but I'm sure he can get a revision out to us by tomorrow morning. It seems that Ahmed's presentation is based on some important assumptions. Most of the questions that were raised were really about those assumptions. It might help us all if Ahmed lists those assumptions so that we can see how they influence the analysis. Then, he'll have to incorporate the increase in unit sales and see what's going on with individual product lines. Also, let's see how things change with changes in product mix, and we may want to drop Motor 5. Ahmed will have to incorporate price changes and consider taxes, investment, and raises. Then he can look at the effect of product emphasis. That should about do it. Once we get Ahmed's revised analysis, we can all take a look at the numbers and think about them for a few days. We'll meet again next week. Ahmed can bring the laptop, and we can do some "what if" analysis on the spot. As he was leaving, Salem said, "Ahmed, before we meet next time, go down to the production floor and get information. It's a waste of time for all of us to meet just to give you information. And send the CVP out ahead so we can think more about changes that could occur next year. Also, bring a computer projector so we can all see how any changes affect overall results, then we can make plans for the next period with better information, and we'll not be caught off guard so often. Ahmed was annoyed that Mohsen hadn't told him to go down to the production floor and over to marketing earlier. He also realized that he should have thought about bringing a projector. When he asked Mohsern about it, he said, "Sometimes when we're introducing a new type of analysis, people need to understand how important their information is to us. Today several people contributed important pieces of information that affect the accuracy of our results. Next time you go out to ask for it, they'll know that they need to give us their best estimates. Otherwise, they might just give us something off the top of their heads because they don't want to take time from other tasks List the assumptions implicit in Ahmed's calculation of the breakeven point. (Hint: List the general , assumptions of CVP analysis, and then apply those assumptions specifically to this case.) Create a spreadsheet that can be used for sensitivity analysis. 2. list the possible cho ices given in the case for the amount of (a) fixed cost, (b) the volume per produc 3. and (c) the variable costs. 4. Pick specific values from Part 3 to use in the spreadsheet and explain why you chose each one. 5. What is the breakeven point in revenues? 6. Calculate the margin of safety in revenues and calculate operating leverage. 7. At what level of operations will the investment in capacity be covered, ignoring the anticipated increase in labor costs and salaries? At what level of operations will the company be able to meet union demands, ignoring any bonuses fo management? 8. At what level of operations will the company be able to increase capacity and give raises to laborers and management? 9. 10. How much can the company spend on new investments for additional capacity, above the planned 11. How can the breakeven analysis help the managers decide whether to alter the existing product 12. What factors limit the usefulness of this type of CVP analysis? 13. Explain how and why biases might affect the CVP analysis for this company. level of investment? emphasis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts