Question: i will give thumbs up AA 4-2 Comparative Analysis LO A2 Key comparative figures for Apple and Google follow. Required 1. Compute the amount of

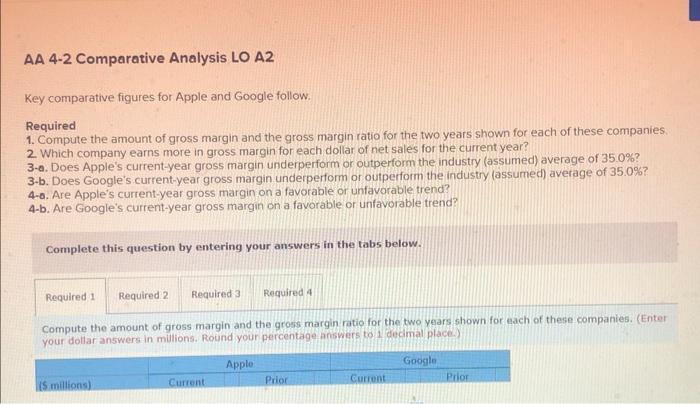

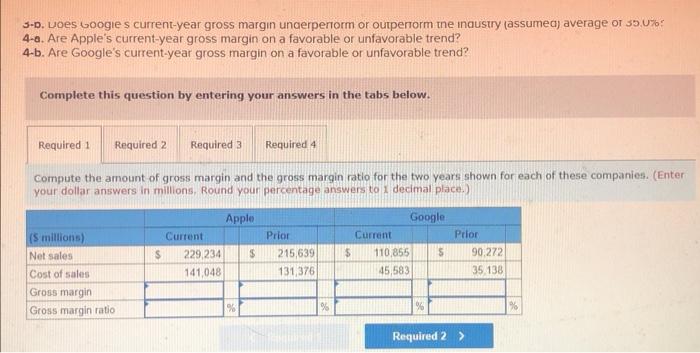

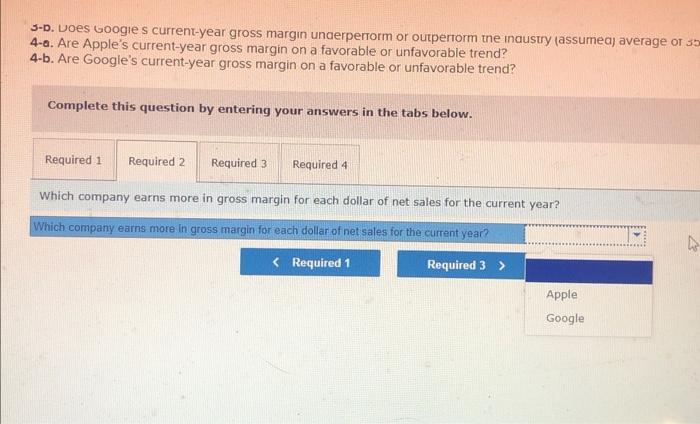

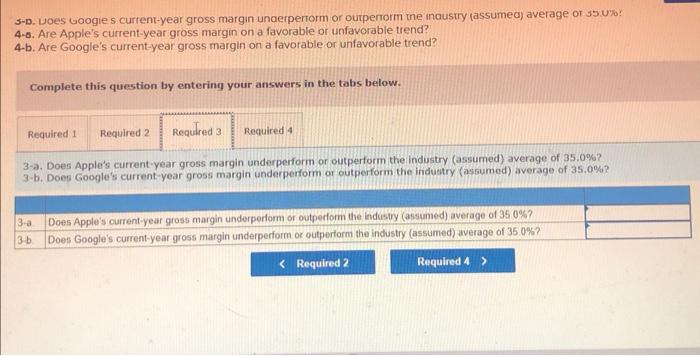

AA 4-2 Comparative Analysis LO A2 Key comparative figures for Apple and Google follow. Required 1. Compute the amount of gross margin and the gross margin ratio for the two years shown for each of these companies 2. Which company earns more in gross margin for each dollar of net sales for the current year? 3-a. Does Apple's current-year gross margin underperform or outperform the industry (assumed) average of 35.0%? 3-b. Does Google's current year gross margin underperform or outperform the industry (assumed) average of 35.0%? 4-0. Are Apple's current-year gross margin on a favorable or unfavorable trend? 4-b. Are Google's current-year gross margin on a favorable or unfavorable trend? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the amount of gross margin and the gross margin ratio for the two years shown for each of these companies. (Enter your dollar answers in millions. Round your percentage answers to decimal place.) Apple Google Current Prior Current Prior S millions) 3-0. Voes Googies current-year gross margin underperform or outperform the inaustry (assumeaj average of 35.0% 4-0. Are Apple's current-year gross margin on a favorable or unfavorable trend? 4-b. Are Google's current-year gross margin on a favorable or unfavorable trend? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the amount of gross margin and the gross margin ratio for the two years shown for each of these companies. (Enter your dollar answers in millions. Round your percentage answers to decimal place.) (5 millions) Net sales Cost of sales Gross margin Gross margin ratio Apple Current 229 234 $ 141,048 Prior 215,639 131,376 Google Current $ 110 855 $ 45,583 Prior 90.272 35.138 96 9 Required 2 > 3-b. Does Googies current-year gross margin underperform or outperform the inausty (assumea, average of 35 4-6. Are Apple's current-year gross margin on a favorable or unfavorable trend? 4-b. Are Google's current-year gross margin on a favorable or unfavorable trend? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Which company earns more in gross margin for each dollar of net sales for the current year? Which company earns more in gross margin for each dollar of net sales for the current year? Apple Google 3-D. Loes Google s current-year gross margin underperform or outpenorm the inaustry assumed average or 35.0%! 4-6. Are Apple's current-year gross margin on a favorable or unfavorable trend? 4-b. Are Google's current-year gross margin on a favorable or unfavorable trend? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 3-a. Does Apple's current year gross margin underperform or outperform the industry (assumed) average of 35.0%? 3-b. Does Google's current year gross margin underperform or outperform the industry (assumed) average of 35.0%? 3-a 3 b Does Apple's current year gross margin underperform or outperform the Industry assumed) average of 350%? Does Google's current year gross margin underperform or outperform the industry (assumed) average of 350% 3-0. Does Googies current-year gross margin underperform or outperform the inaustry (assumed av 4-a. Are Apple's current-year gross margin on a favorable or unfavorable trend? 4-b. Are Google's current-year gross margin on a favorable or unfavorable trend? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4-a. Are Apple's current-year gross margin on a favorable or unfavorable trend? 4-b. Are Google's current-year gross margin on a favorable or unfavorable trend? 4-a. Are Apple's current-year gross margin on a favorable or unfavorable trend? 4-6. Are Google's current-year gross margin on a favorable or unfavorable trend?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts