Question: I will upvote if answer correct 600 Question 8 The Balance Sheet of M/s. Sundry Ltd. as on 31-03-2021 is follows: Liabilities * Assets Share

I will upvote if answer correct

I will upvote if answer correct

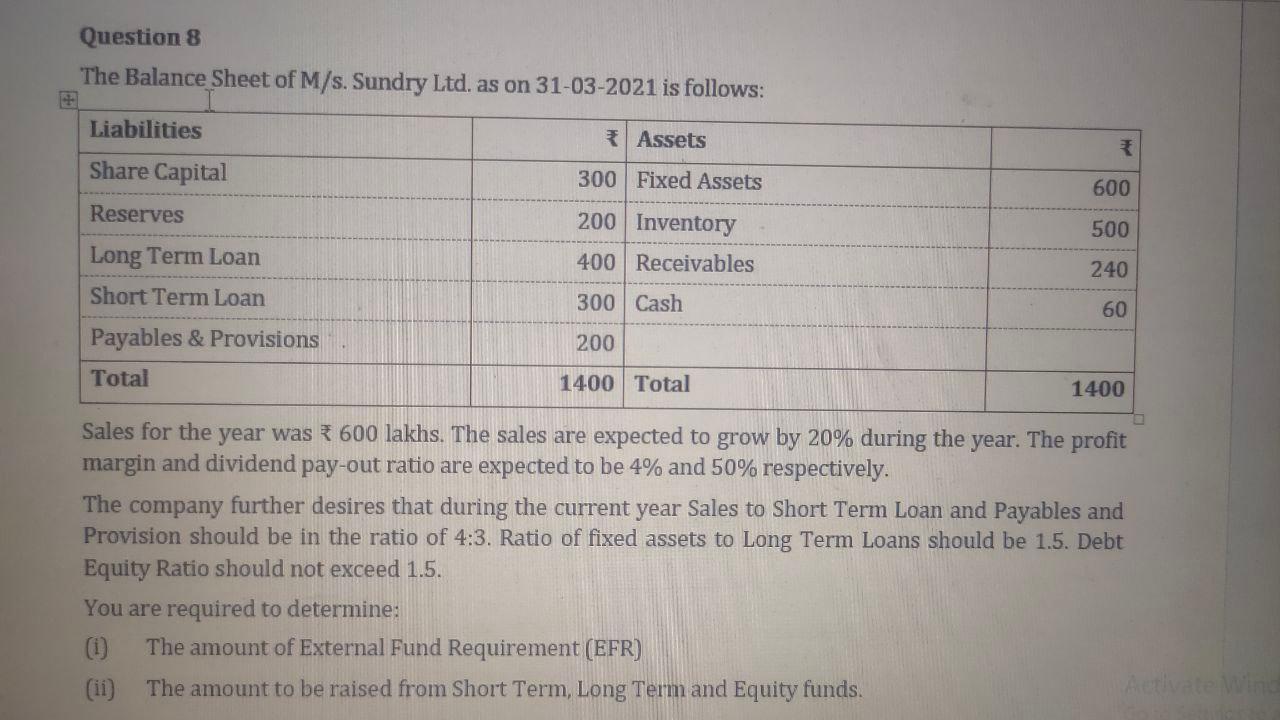

600 Question 8 The Balance Sheet of M/s. Sundry Ltd. as on 31-03-2021 is follows: Liabilities * Assets Share Capital 300 Fixed Assets Reserves 200 Inventory Long Term Loan 400 Receivables Short Term Loan 300 Cash Payables & Provisions 200 Total 1400 Total 500 240 60 1400 Sales for the year was 600 lakhs. The sales are expected to grow by 20% during the year. The profit margin and dividend pay-out ratio are expected to be 4% and 50% respectively. The company further desires that during the current year Sales to Short Term Loan and Payables and Provision should be in the ratio of 4:3. Ratio of fixed assets to Long Term Loans should be 1.5. Debt Equity Ratio should not exceed 1.5. You are required to determine: 1) The amount of External Fund Requirement (EFR) (ii) The amount to be raised from Short Term Long Term and Equity funds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts