Question: I wonder how to solve this problem. (3 points) Consider two securities that pay risk-free cash flows over the next two years and that have

I wonder how to solve this problem.

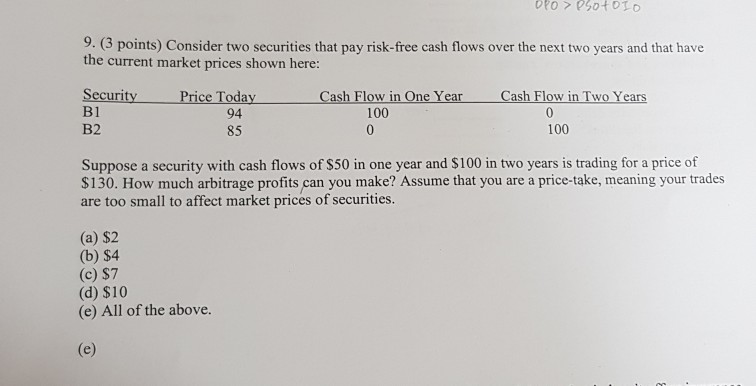

(3 points) Consider two securities that pay risk-free cash flows over the next two years and that have the current market prices shown here: Security B1 B2 Price Today Cash Flow in One Year Cash Flow in Two Years 100 94 85 100 Suppose a security with cash flows of S50 in one year and $100 in two years is trading for a price of S130. How much arbitrage profits can you make? Assume that you are a price-take, meaning your trades are too small to affect market prices of securities. (a) $2 (b) $4 (c) $7 (d) $10 (e) All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts