Question: I would like for the question to be solved using this method, and thank you in advance! AUM AInuIean llnlvonllyOl'Eholldclom Problem 2 {25 points) A

I would like for the question to be solved using this method, and thank you in advance!

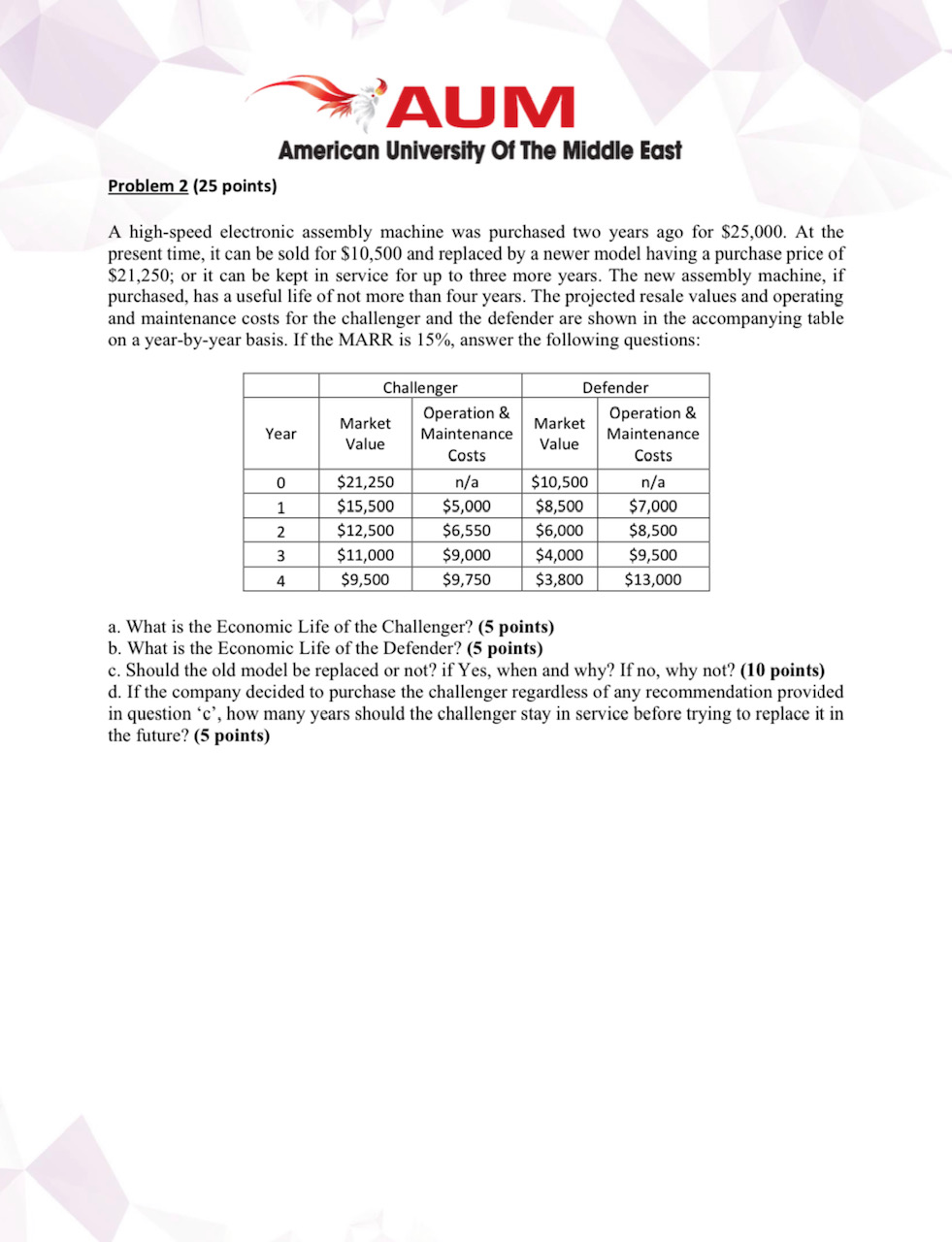

AUM AInuIean llnlvonllyOl'Eholldclom Problem 2 {25 points) A high-speed electronic assembly machine was purchased two years ago for $25,000. At the present time, it can be sold for $10,500 and replaced by a newer model having a purchase price of $21,250; or it can be kept in service for up to three more years. The new assembly machine, if purchased, has a useful life of not more than four years. The projected resale values and operating and maintenance costs for the challenger and the defender are shown in the accompanying table on a year-by-year basis. If the MARK is 15%, answer the following questions: Chane er 0 oration 8: O eration E: Market p- Market p. Year Maintenance Maintenance Value Value Costs Costs rm 1 515.500 55 000 $12,500 $6 550 56.000 58.500 $11,000 $9,000 $4,000 $9,500 l-_- a. What is the Economic Life of the Challenger? (5 points) b. What is the Economic Life of the Defender? (5 points) c. Should the old model be replaced or not? if Yes, when and why? Ifno, why not? {10 points) d. If the company decided to purchase the challenger regardless of any recommendation provided in question 'c', how many years should the challenger stay in service before trying to replace it in the future? {5 points) nra \f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts