Question: I would like to get your help on the answer with explanations. Even how to approach (step-by-step) Thank you. Use the monthly stock returns of

I would like to get your help on the answer with explanations. Even how to approach (step-by-step) Thank you.

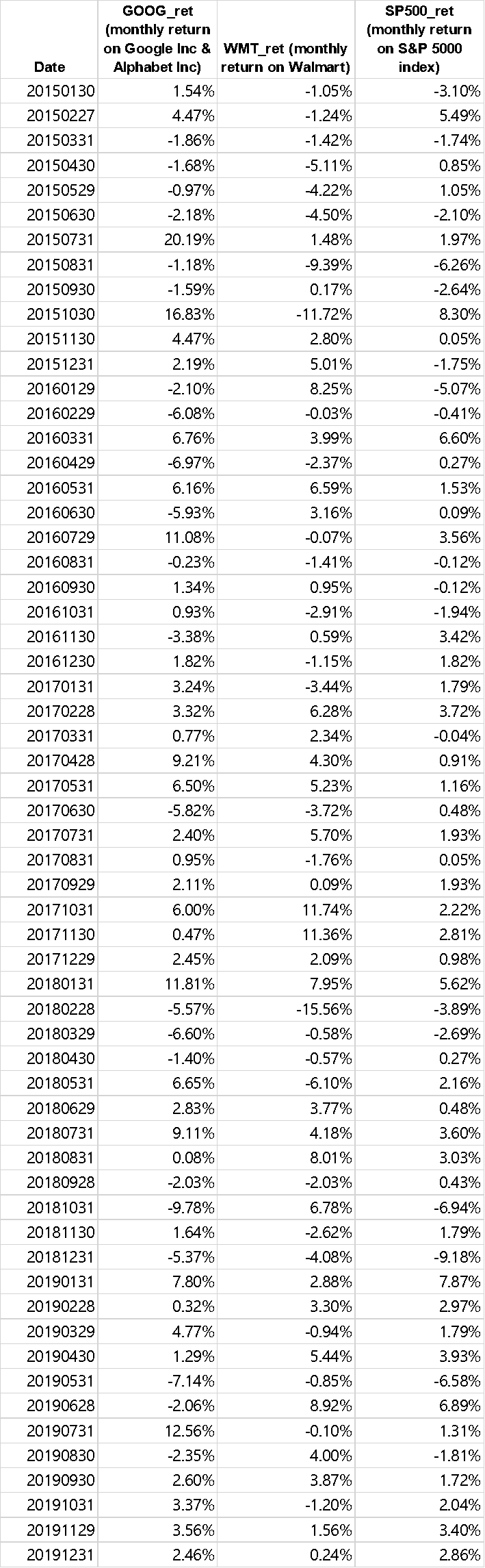

Use the monthly stock returns of Google/Alphabet Company (ticker: GOOG) and Wal-Mart Stores (ticker: WMT), and the returns on the S&P500 market index for the period from January 2015 to December 2019 to answer the following questions. T

Calculate the betas of the two stocks using the monthly stock returns and the S&P500 index returns over the 5 years (2015-2019) by (i) applying the covariance formula, (ii) regressing stock returns against the market returns, and (iii) regressing excess stock returns against the excess market returns assuming a monthly risk free rate of 0.06%. Comment on the betas obtained using the three methods.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts