Question: I would like to get your help on the resolution with explanation. It would be appreciated if you share way to solve it with answers.

I would like to get your help on the resolution with explanation. It would be appreciated if you share way to solve it with answers. Thank you very much.

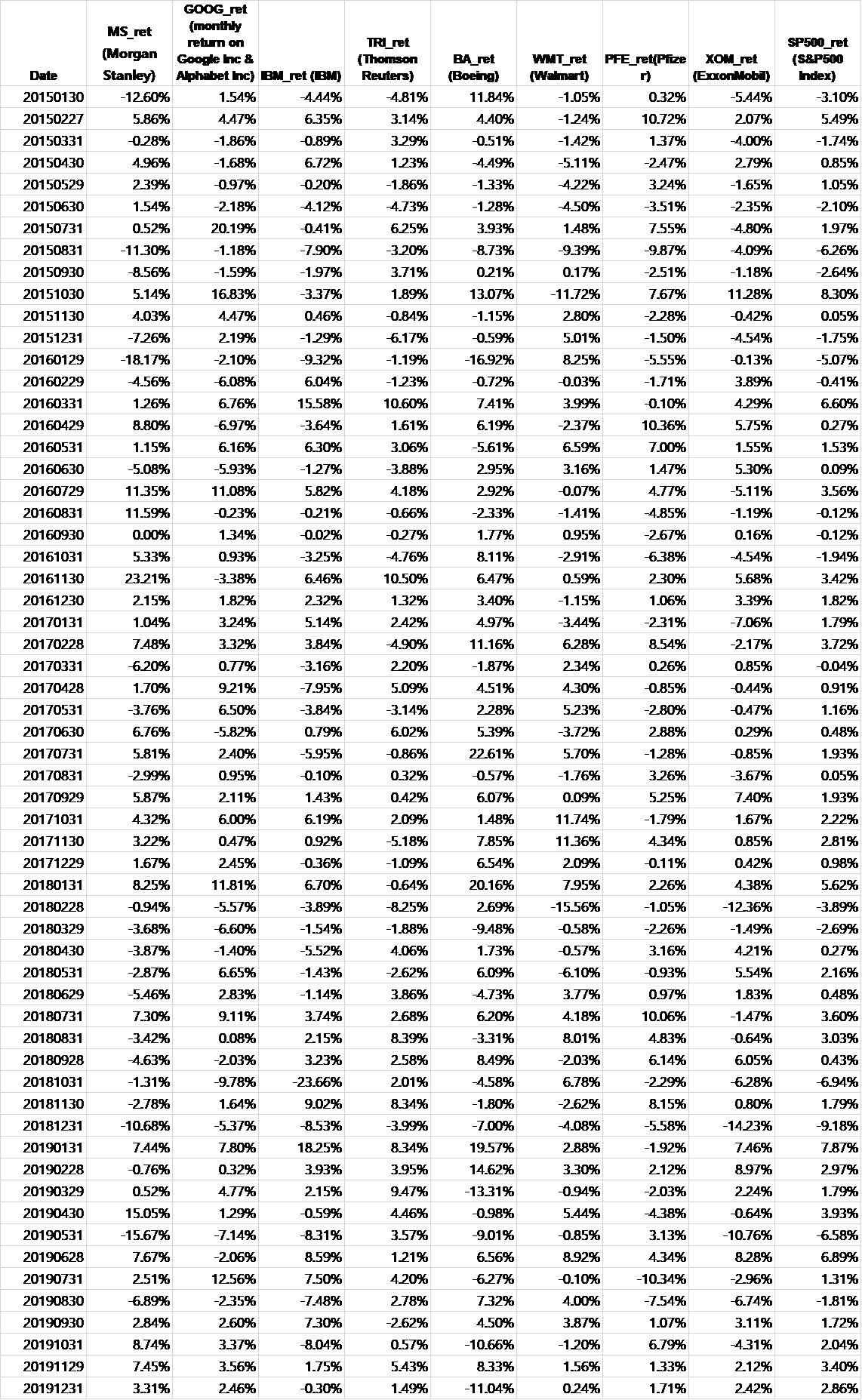

To answer the questions below, use the monthly returns on the following stocks for the period from January 2015 to December 2019: Morgan Stanley (ticker: MS), Google/Alphabet Company (ticker: GOOG), IBM (ticker: IBM), Thomson Reuters (ticker: TRI), Boeing (ticker: BA), Wal-Mart (ticker: WMT), Pfizer (ticker: PFE), and ExxonMobil (ticker: XOM), and the returns on the S&P500 market index.

Compute the beta for each stock and each portfolio. What is the relationship between individual stock betas and portfolio betas?

Portfolio

1 Morgan Stanley

2 Morgan Stanley, Google

3 Morgan Stanley, Google, IBM

4 Morgan Stanley, Google, IBM, Thomson Reuters

5 Morgan Stanley, Google, IBM, Thomson Reuters, Boeing

6 Morgan Stanley, Google, IBM, Thomson Reuters, Boeing, Wal-Mart

7 Morgan Stanley, Google, IBM, Thomson Reuters, Boeing, Wal-Mart, Pfizer

8 Morgan Stanley, Google, IBM, Thomson Reuters, Boeing, Wal-Mart, Pfizer, ExxonMobil

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts