Question: I would like to know the answer by step by step. and detail explanation (B) Answer the following questions based on the diagram below Fixed

I would like to know the answer by step by step. and detail explanation

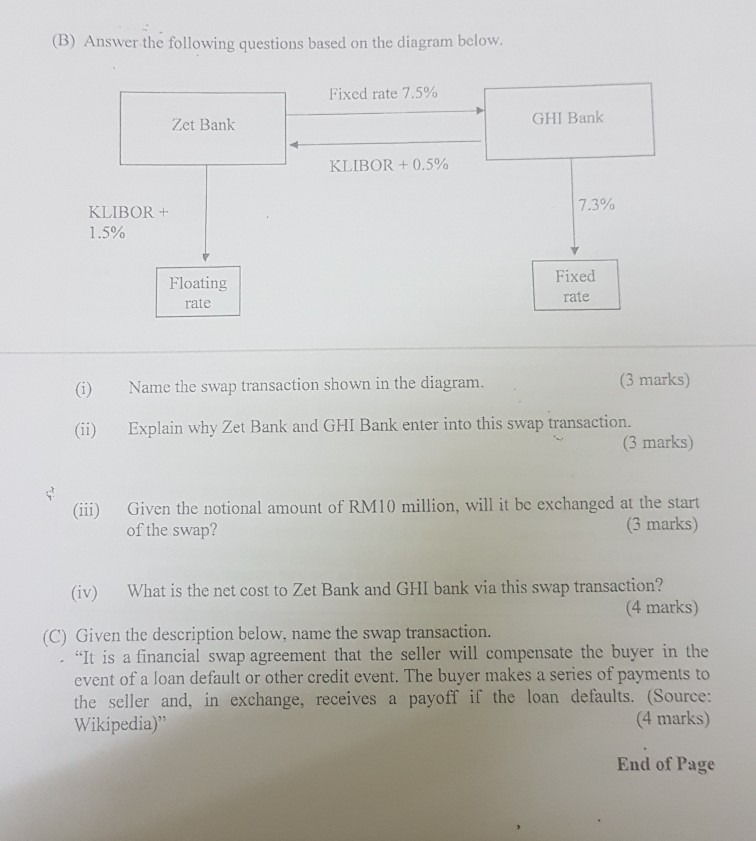

(B) Answer the following questions based on the diagram below Fixed rate 7.5% Zet Bank GHI Bank KLIBOR + 0.5% 7.3% KLIBOR + 1.5% Floating rate Fixed rate (3 marks) (i) Name the swap transaction shown in the diagram (ii) Explain why Zet Bank and GHI Bank enter into this swap transaction (3 marks) (ii) Given the notional amount of RM10 million, will it be exchanged at the start (3 marks) of the swap? (iv) What is the net cost to Zet Bank and GHI bank via this swap transaction? (4 marks) (C) Given the description below, name the swap transaction. . "It is a financial swap agreement that the seller will compensate the buyer in the event of a loan default or other credit event. The buyer makes a series of payments to the seller and, in exchange, receives a payoff if the loan defaults. (Source: (4 marks) Wikipedia)" End of Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts