Question: I would very much appreciate the help. An answer key is provided which includes some of the answers. Thank you for your help N- C

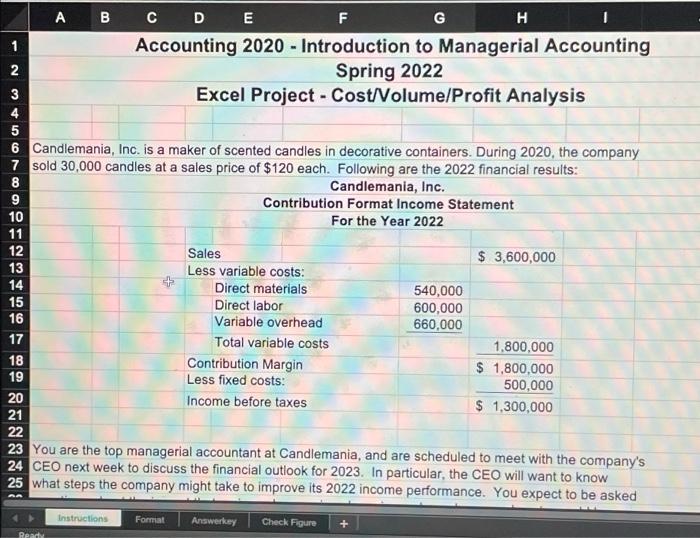

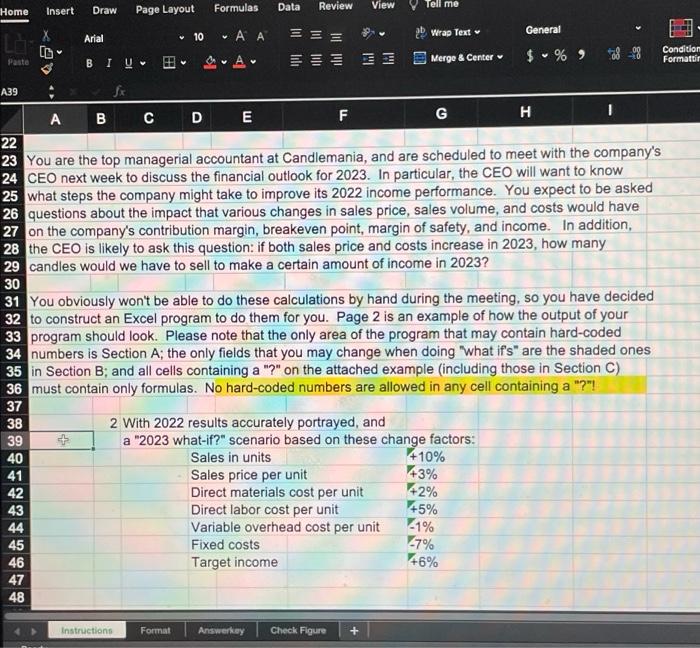

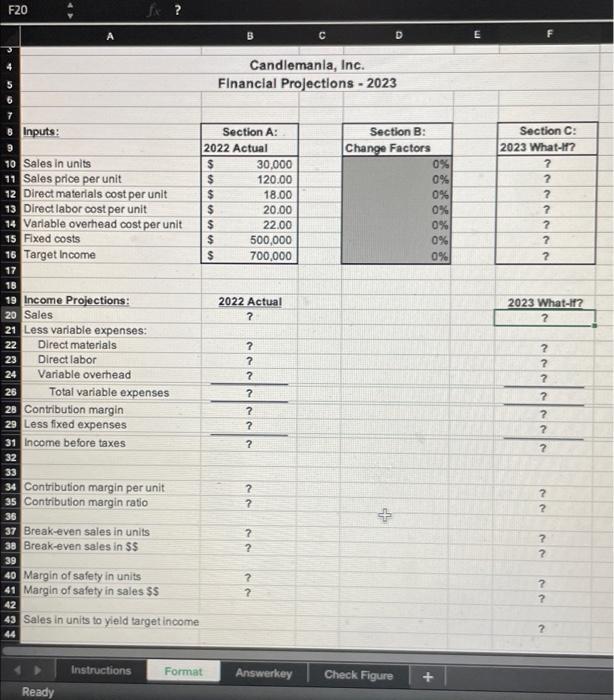

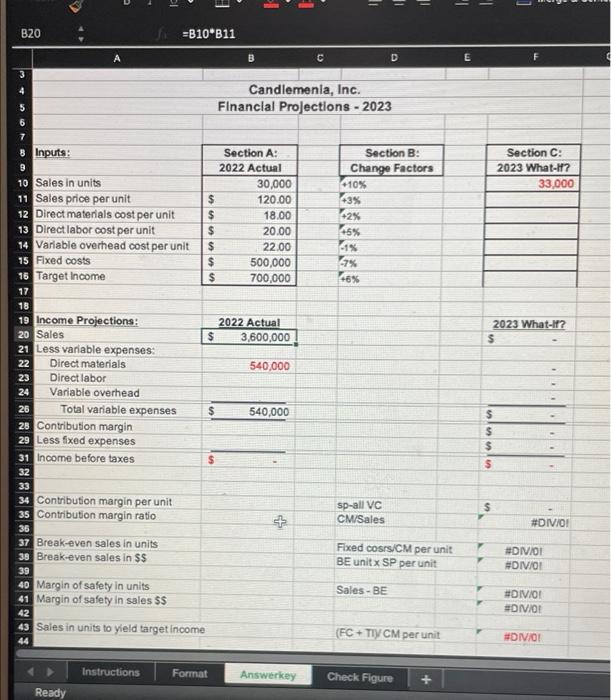

N- C D E F G H 1 Accounting 2020 - Introduction to Managerial Accounting 2 Spring 2022 3 Excel Project - Cost/Volume/Profit Analysis 4 5 6 Candlemania, Inc. is a maker of scented candles in decorative containers. During 2020, the company 7 sold 30,000 candles at a sales price of $120 each. Following are the 2022 financial results: 8 Candlemania, Inc. 9 Contribution Format Income Statement 10 For the Year 2022 11 12 Sales $ 3,600,000 13 Less variable costs: 14 Direct materials 540,000 15 Direct labor 600,000 16 Variable overhead 660,000 17 Total variable costs 1.800.000 18 Contribution Margin $ 1,800,000 19 Less fixed costs: 500,000 Income before taxes $ 1,300,000 21 22 23 You are the top managerial accountant at Candlemania, and are scheduled to meet with the company's 24 CEO next week to discuss the financial outlook for 2023. In particular, the CEO will want to know 25 what steps the company might take to improve its 2022 income performance. You expect to be asked 52 20 Instructions Format Answerkey Check Figure + Red Draw Page Layout Home Insert Formulas Data Review View Tell me Arial 10 General == Wrap Text Lda A A A ili III Condition Formattir Paste BIVE $ % ) Merge & Center V V A39 fx A B C D E F G H 22 23 You are the top managerial accountant at Candlemania, and are scheduled to meet with the company's 24 CEO next week to discuss the financial outlook for 2023. In particular, the CEO will want to know 25 what steps the company might take to improve its 2022 income performance. You expect to be asked 26 questions about the impact that various changes in sales price, sales volume, and costs would have 27 on the company's contribution margin, breakeven point, margin of safety, and income. In addition, 28 the CEO is likely to ask this question: if both sales price and costs increase in 2023, how many 29 candles would we have to sell to make a certain amount of income in 2023? 30 31 You obviously won't be able to do these calculations by hand during the meeting, so you have decided 32 to construct an Excel program to do them for you. Page 2 is an example of how the output of your 33 program should look. Please note that the only area of the program that may contain hard-coded 34 numbers is Section A; the only fields that you may change when doing what if's" are the shaded ones 35 in Section B; and all cells containing a "?" on the attached example (including those in Section C) 36 must contain only formulas. No hard-coded numbers are allowed in any cell containing a "?"! 37 38 2 With 2022 results accurately portrayed, and 39 a "2023 what-if?" scenario based on these change factors: 40 Sales in units 410% 41 Sales price per unit +3% 42 Direct materials cost per unit 43 Direct labor cost per unit 44 Variable overhead cost per unit 45 Fixed costs 46 Target income 47 48 42% 45% 21% -7% 46% Instructions Format Answerkey Check Figure + F20 fx ? B . D E F a 4 Candlemanla, Inc. Financial Projections - 2023 Inputs: 10 Sales in units 11 Sales price per unit 12 Direct materials cost per unit 13 Direct labor cost per unit 14 Variable overhead cost per unit 15 Fixed costs 16 Target Income 17 Section A: 2022 Actual $ 30,000 $ 120.00 $ 18.00 $ 20.00 $ 22.00 $ 500,000 $ 700,000 Section B: Change Factors 0% 0% 0% 0% 0% 0% 0% Section C: 2023 What ? ? 2 ? ? ? ? 2 18 2022 Actual ? 2023 What-112 ? 19 Income Projections: 20 Sales 21 Less variable expenses: 22 Direct materials 23 Direct labor 24 Variable overhead 26 Total variable expenses 28 Contribution margin 29 Less fixed expenses 31 income before taxes 32 ? ? 2 ? ? ? ? ? ? ? ? ? 2 ? 33 34 Contribution margin per unit 35 Contribution margin ratio 2 ? ? 2 36 + ? 2 ? ? 37 Break-even sales in units 38 Break-even sales in 55 39 40 Margin of safety in units 41 Margin of safety in sales $S 42 43 Sales in units to yield target income ? ? ? ? 2 44 Instructions Format Answerkey Check Figure + Ready - - D li [ B20 =B10*B11 A B C D E F 3 4 Candlemenla, Inc. Financial Projections - 2023 Section A: 2022 Actual 30,000 $ 120.00 $ 18.00 $ 20.00 $ 22.00 $ 500,000 $ 700,000 Section B: Change Factors +10% 43% 42% 15% Section C: 2023 What-112 33.000 45 47% 46% 2022 Actual $ 3,600,000 2023 What-11? $ 540,000 B Inputs: 3 10 Sales in units 11 Sales price per unit 12 Direct materials cost per unit 13 Direct labor cost per unit 14 Variable overhead cost per unit 15 Fixed costs 16 Target Income 17 18 19 Income Projections: 20 Sales 21 Less variable expenses: 22 Direct materials 23 Direct labor 24 Variable overhead 26 Total variable expenses 28 Contribution margin 29 Less fixed expenses 31 Income before taxes 32 33 34 Contribution margin per unit 35 Contribution margin ratio 36 37 Break-even sales in units 38 Break-even sales in $5 39 40 Margin of safety in units 41 Margin of safety in sales SS $ 540,000 $ $ $ $ $ + sp-all VC CM Sales #DIV/0! Fixed coss/CM per unit BE unit x SP per unit #DIV/01 #DIV/0! Sales - BE #DIV/OI #DIV/01 42 43 Sales in units to yield target income (FC+TIY CM per unit #DIV/0! 44 Instructions Format Answerkey Check Figure Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts