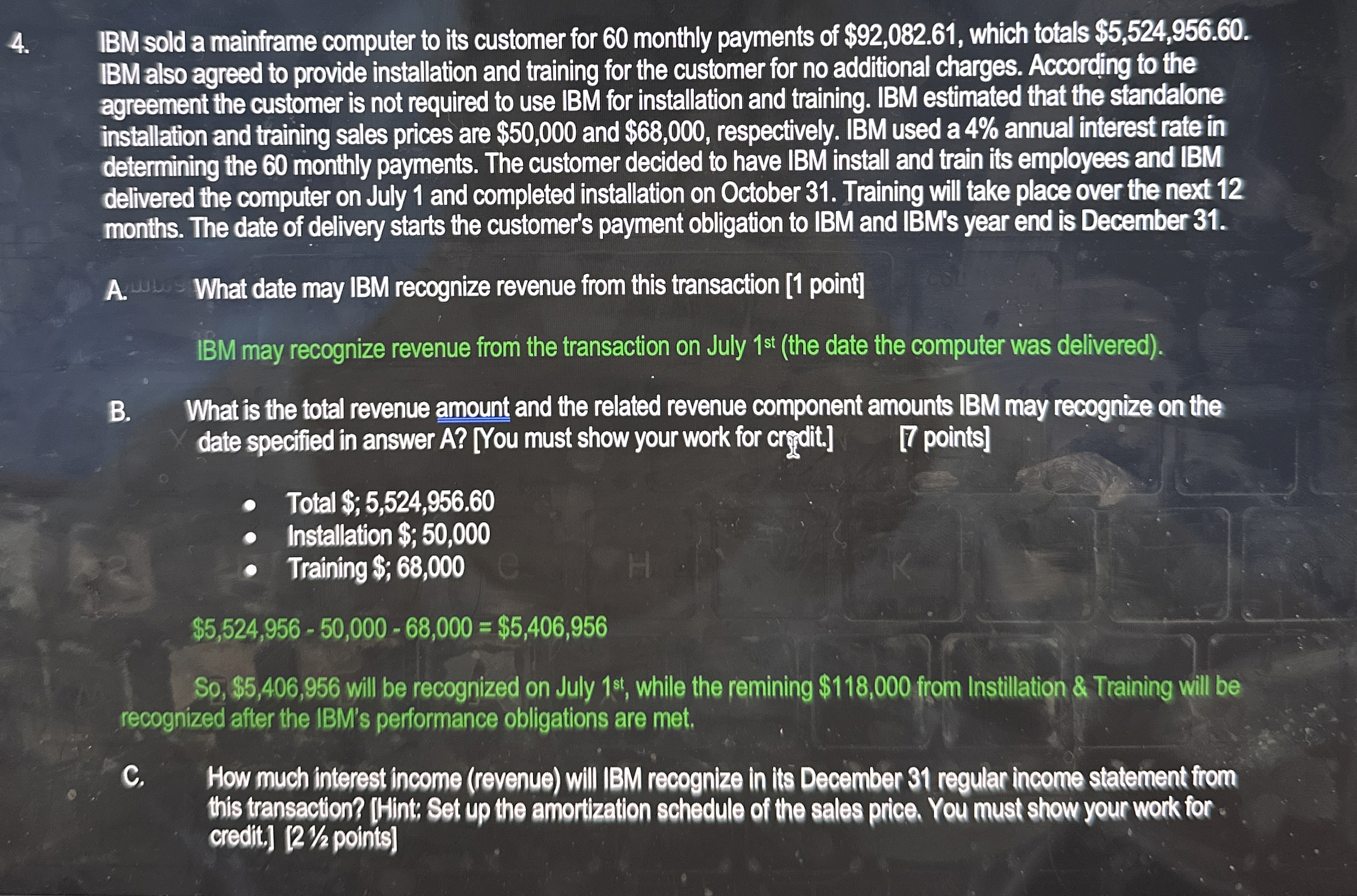

Question: IBM sold a mainframe computer to its customer for 6 0 monthly payments of $ 9 2 , 0 8 2 . 6 1 ,

IBM sold a mainframe computer to its customer for monthly payments of $ which totals $

IBM also agreed to provide installation and training for the customer for no addifional charges. According to the

agreement the customer is not required to use IBM for installation and training. IBM estimated that the standalone

installation and training sales prices are $ and $ respectively. IBM used a annual interest rate in

determining the monthly payments. The customer decided to have IBM install and train its employees and IBM

delivered the computer on July and completed installation on October Training will take place over the next

months. The date of delivery starts the customer's payment obligation to IBM and IBM's year end is December

A What date may IBM recognize revenue from this transaction point!

BM may recognize revenue from the transaction on July the date the computer was delivered

B What is the total revenue amount and the related revenue component amounts IBM may recognize on the

date specified in answer AYou must show your work for crgalit.

points

Total $;

Installation $;

Training $;

$$

So $ will be recognized on July st while the remining $ from Instillation & Training will be

recognized after the IBM's performance obligations are met.

C How much interest income revenue will IBM recognize in its December regular income statement from

this transaction? Hint Set up the amorization schedule of the sales price. You must show your work for

credit, points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock