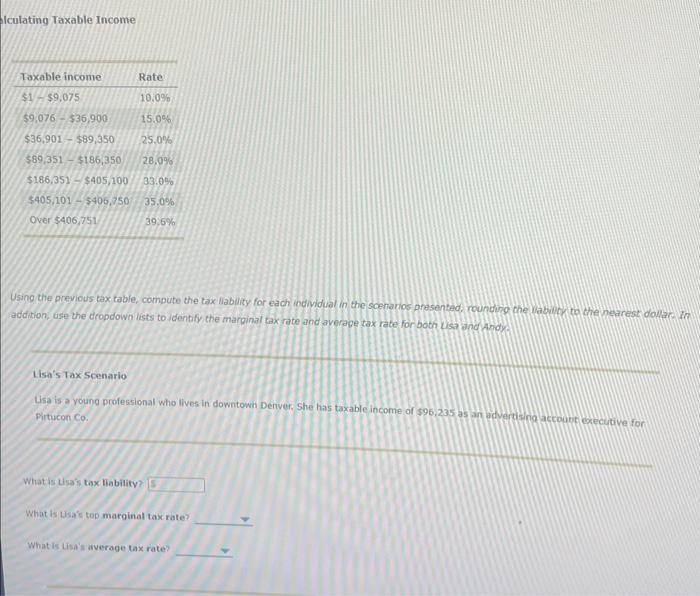

Question: Iculating Taxable Income Using the previous tax table, compute the tax liablity for each individual in the scenarios prasented, rounching phe Wabindrito che nearest doultrin

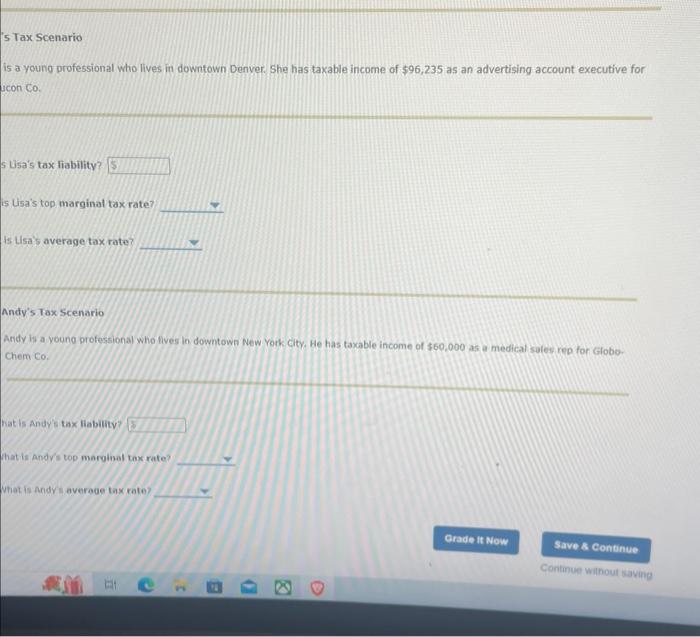

Iculating Taxable Income Using the previous tax table, compute the tax liablity for each individual in the scenarios prasented, rounching phe Wabindrito che nearest doultrin fol addition, use the dropdown lists to identify the marpinal tax rate and averape tax rate for both lisa wha Andye Lisn's Tax Scenario Privecon Co. What is Lya's tox Habilify? What is Usa's top marginal tax rate? What is tisa's average tax rate? 's Tax Scenario is a youno professional who lives in downtown Denver. She has taxable income of $96,235 as an advertising account executive for ucon Co. 5 Lisa's tax liability? is Usa's top marginal tax rate? Is Lisa's average tax rate? Andy's Tax Scenario Andy is a youne professional who fives in downtown New York City. He has taxable income of $60,000 as a medical sules rep for Globe-: Chem Co. hat is Andy's tax liability? that is Andr's top marolual tox rate? What is Andy averaoe tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts