Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Identifying and Recording Impairment Loss on Fixed Asset Supreme Inc. has equipment with an original cost of $800,000, and accumulated depreciation of $300,000. Supreme

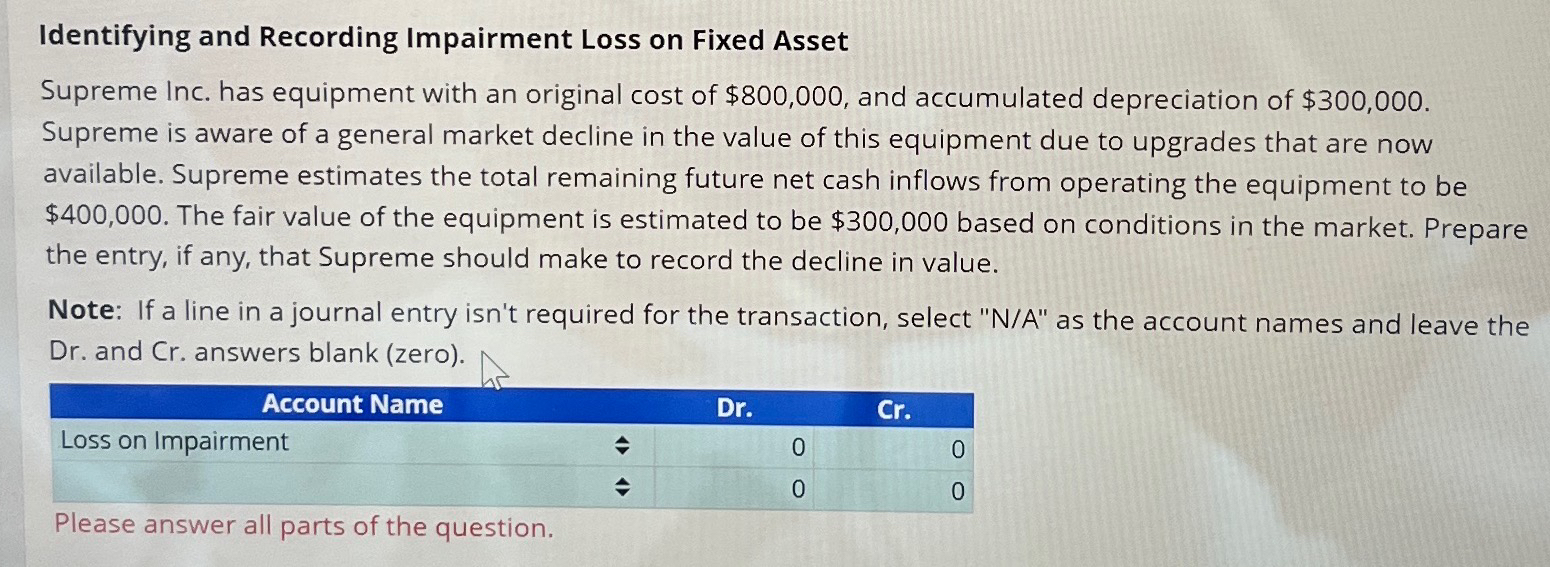

Identifying and Recording Impairment Loss on Fixed Asset Supreme Inc. has equipment with an original cost of $800,000, and accumulated depreciation of $300,000. Supreme is aware of a general market decline in the value of this equipment due to upgrades that are now available. Supreme estimates the total remaining future net cash inflows from operating the equipment to be $400,000. The fair value of the equipment is estimated to be $300,000 based on conditions in the market. Prepare the entry, if any, that Supreme should make to record the decline in value. Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). Account Name Loss on Impairment Please answer all parts of the question. Dr. Cr. 0 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Supreme Inc should record the impairment loss on the f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642ba65a4518_975272.pdf

180 KBs PDF File

6642ba65a4518_975272.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started