Question: If answer is 6.06 1. What do Cu and Cd mean? 2. how to calculate? excel? C u = Max ([65-55, 0] = 10 C

![2. how to calculate? excel? Cu = Max ([65-55, 0] = 10](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fd38a9cd6c0_14566fd38a970f26.jpg)

If answer is 6.06

1. What do Cu and Cd mean?

2. how to calculate? excel?

Cu = Max ([65-55, 0] = 10

Cd = Max [35-55, 0] = 0

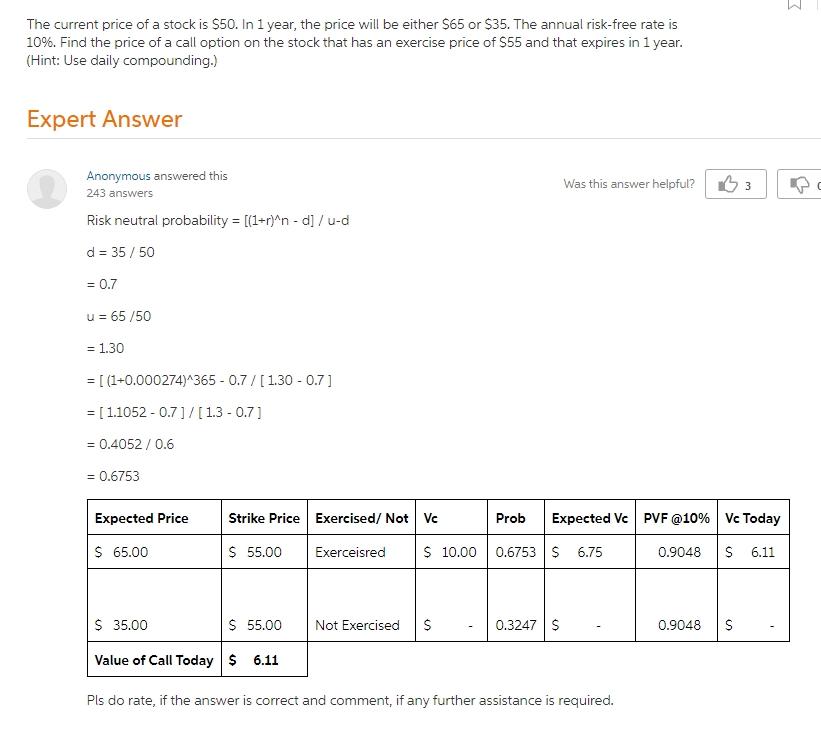

The current price of a stock is $50. In 1 year, the price will be either $65 or $35. The annual risk-free rate is 10%. Find the price of a call option on the stock that has an exercise price of $55 and that expires in 1 year. (Hint: Use daily compounding.) Expert Answer Was this answer helpful? 3 3 Anonymous answered this 243 answers Risk neutral probability = ((1+r)^n -d] /u-d d = 35 / 50 = 0.7 u = 65/50 = 1.30 = [ (1+0.000274)^365 -0.7/[1.30 -0.7] = [1.1052 -0.7]/[1.3 -0.7] = 0.4052 / 0.6 = 0.6753 Expected Price Strike Price Exercised/ Not Ve Prob Expected VC PVF @10% Vc Today $ 65.00 $ 55.00 Exerceisred $ 10.00 0.6753 $ 6.75 0.9048 S 6.11 $ 35.00 $ 55.00 Not Exercised $ 0.3247 $ 0.9048 S Value of Call Today $ 6.11 Pls do rate, if the answer is correct and comment, if any further assistance is required. C. = Max ([65-55, 0] = 10 Ca = Max [35-55, 0] = 0 So the intrinsic value in one period binomial model is (A) $ 10 and $ 0 r= (1+. 10) = 1.10 Upside factor (u) = 65/50 = 1.30, Downside factor (a) = 35/50 = 0.70 As we know that-- P = (r-d)/(u-d) = (1.10-0.70)/(1.30-0.70) = 0.6667 the present value of the expected payout as follows - = {10*0.6667+0(1-0.6667)}1.1 = 6.667/1.1 = $ 6.06 I do have two anwers from chegg. Which one is the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts