Question: If shareholders are granted a preemptive right they will: A be given the choice of receiving dividends either in sash or in additional shares of

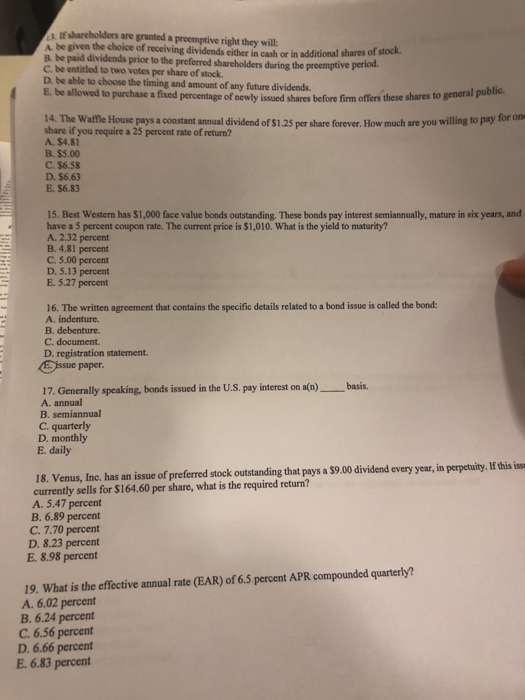

If shareholders are granted a preemptive right they will: A be given the choice of receiving dividends either in sash or in additional shares of stock. B. be paid dividends prior to the preferred shareholders during the preemptive period. D be able to choose the timing and amount of any future dividends. B. be allowed to purchase a fixed percentage of newly issued shares before firm offers these shares to Be Ne to choose the res per share fred shareholders club or in additional es before firm offers these shares to general public. e forever. How much are you willing to pay for on 14. The Wate House pays a constant annual dividend of $1.25 per share forever. How much are you willing top share if you require a 25 percent rate of return? A. $4.81 B. $5.00 C. $6.58 D. $6.63 E. $6.83 H 15. Best Western has $1,000 face value bonds outstanding. These bonds pay interest semiannually, mature in six years, and have a 5 percent coupon rate. The current price is $1,010. What is the yield to maturity? A. 2.32 percent B. 4.81 percent C. 5.00 percent D. 5.13 percent E. 5.27 percent un u 16. The written agreement that contains the specific details related to a bond issue is called the bond: A. indenture. B. debenture. C. document. D. registration statement. E issue paper. 17. Generally speaking, bonds issued in the U.S.pay interest on a(n) basis. A. annual B. semiannual C. quarterly D. monthly E. daily 18. Venus, Inc. has an issue of preferred stock outstanding that pays a $9.00 dividend every year, in perpetuity. If this is currently sells for $164.60 per share, what is the required return? A. 5.47 percent B. 6.89 percent C. 7.70 percent D. 8.23 percent E. 8.98 percent 19. What is the effective annual rate (EAR) of 6.5 percent APR compounded quarterly? A. 6.02 percent B. 6.24 percent C. 6.56 percent D. 6.66 percent E. 6.83 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts