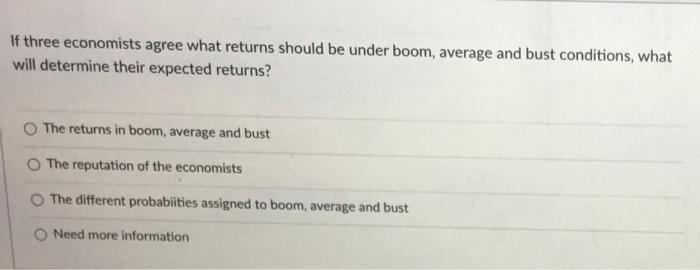

Question: If three economists agree what returns should be under boom, average and bust conditions, what will determine their expected returns? The returns in boom, average

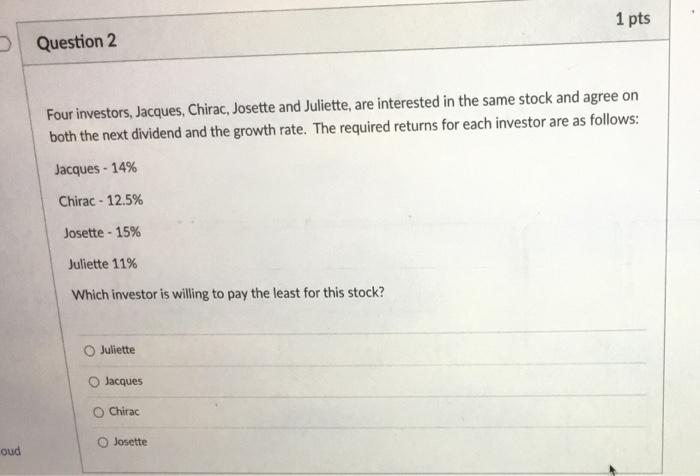

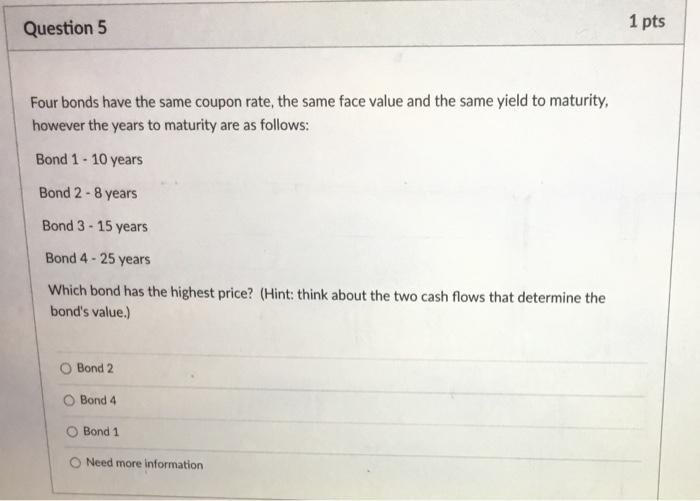

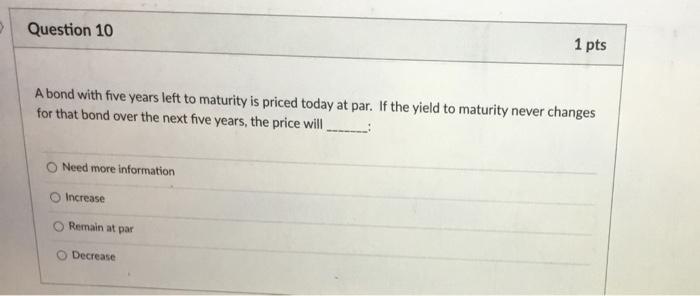

If three economists agree what returns should be under boom, average and bust conditions, what will determine their expected returns? The returns in boom, average and bust The reputation of the economists The different probabiities assigned to boom, average and bust Need more information 1 pts Question 2 Four investors, Jacques, Chirac, Josette and Juliette, are interested in the same stock and agree on both the next dividend and the growth rate. The required returns for each investor are as follows: Jacques - 14% Chirac - 12.5% Josette -15% Juliette 11% Which investor is willing to pay the least for this stock? Juliette Jacques Chirac Josette oud Question 5 1 pts Four bonds have the same coupon rate, the same face value and the same yield to maturity, however the years to maturity are as follows: Bond 1 - 10 years Bond 2-8 years Bond 3 - 15 years Bond 4 - 25 years Which bond has the highest price? (Hint: think about the two cash flows that determine the bond's value.) Bond 2 Bond 4 Bond 1 Need more information Question 10 1 pts A bond with five years left to maturity is priced today at par. If the yield to maturity never changes for that bond over the next five years, the price will _-_- Need more information Increase Remain at par Decrease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts