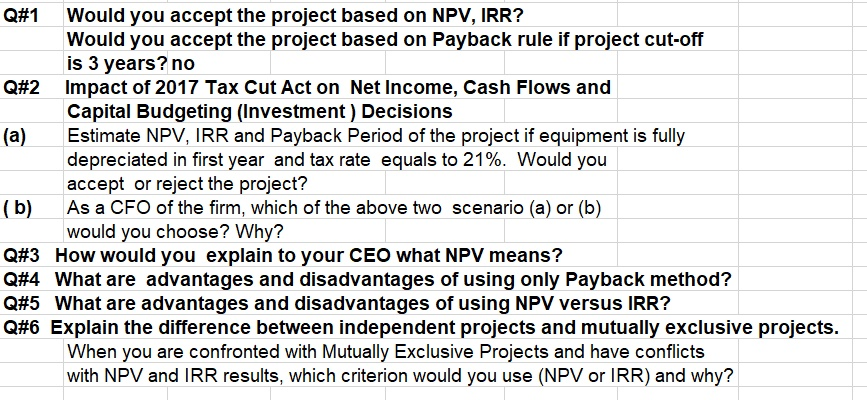

Question: Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off is 3 years?

Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off is 3 years? no Q#2 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and Capital Budgeting (Investment ) Decisions (a) Estimate NPV, IRR and Payback period of the project if equipment is fully depreciated in first year and tax rate equals to 21%. Would you accept or reject the project? (b) As a CFO of the firm, which of the above two scenario (a) or (b) would you choose? Why? Q#3 How would you explain to your CEO what NPV means? Q#4 What are advantages and disadvantages of using only Payback method? Q#5 What are advantages and disadvantages of using NPV versus IRR? Q#6 Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have conflicts with NPV and IRR results, which criterion would you use (NPV or IRR) and why? Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off is 3 years? no Q#2 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and Capital Budgeting (Investment ) Decisions (a) Estimate NPV, IRR and Payback period of the project if equipment is fully depreciated in first year and tax rate equals to 21%. Would you accept or reject the project? (b) As a CFO of the firm, which of the above two scenario (a) or (b) would you choose? Why? Q#3 How would you explain to your CEO what NPV means? Q#4 What are advantages and disadvantages of using only Payback method? Q#5 What are advantages and disadvantages of using NPV versus IRR? Q#6 Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have conflicts with NPV and IRR results, which criterion would you use (NPV or IRR) and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts