Question: if you could find for all years please. I will make sure to thumbs up Project cash flow and NPV. The managers of Classic Aultos

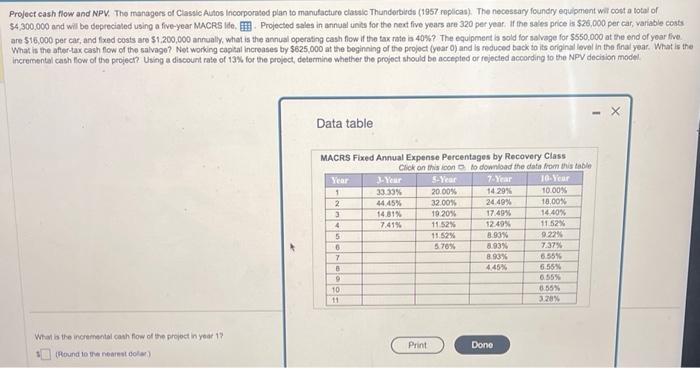

Project cash flow and NPV. The managers of Classic Aultos Incorporatod plan to manutacture classic Thunderbleds (1957 replicas). The necessary foundry equipment wit cost a total of 54,300.000 and will be deprecioled using a five-year MACRS Ide. [ifit. Projected sales in annual units for the neat five years are 320 per year. If the sales price is $26,000 per car, variable costs are $16,000 per car, and fixed costs are $1,200,000 annualy, what is the annual operating cash flow if the tax rate as 40% ? The equipment bsold for savage for $550,000 at the end of year five. What is the aftertax cash flow of the salvage? Net working captal increases by $625,000 at the beginning of the projoct (year 0 ) and is reduced back so its original level in the final year. What is the incremental cash flow of the project? Using a discount rale of 13 sh for the projoct, determine whether the projoct should be accepted or rejected according to the NPV decision model. Data table MACRS Fixed Annual Expense Percentages by Recovery Class nove nn mhic imn = is abswnibad the dofa from this hable What is the incremental cath food of the propect in year 1 ? TPound to tha notest golar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts