Question: If you could help me answer this question I would really appreciate it. I will make sure to give you a thumbs up! 1. In

If you could help me answer this question I would really appreciate it. I will make sure to give you a thumbs up!

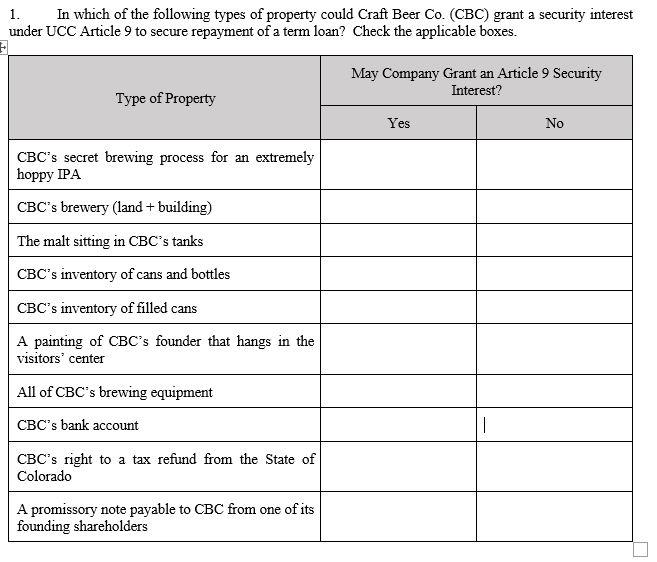

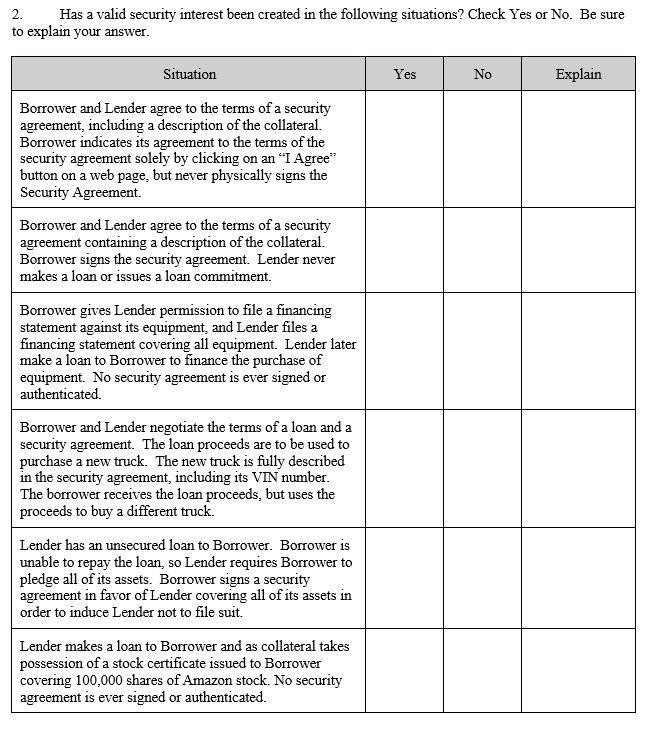

1. In which of the following types of property could Craft Beer Co. (CBC) grant a security interest under UCC Article 9 to secure repayment of a term loan? Check the applicable boxes. May Company Grant an Article 9 Security Interest? Type of Property Yes No CBC's secret brewing process for an extremely hoppy IPA CBC's brewery (land + building) The malt sitting in CBC's tanks CBC's inventory of cans and bottles CBC's inventory of filled cans A painting of CBC's founder that hangs in the visitors' center All of CBC's brewing equipment CBC's bank account | CBC's right to a tax refund from the State of Colorado A promissory note payable to CBC from one of its founding shareholders 2. Has a valid security interest been created in the following situations? Check Yes or No. Be sure to explain your answer. Situation Yes No Explain Borrower and Lender agree to the terms of a security agreement, including a description of the collateral. Borrower indicates its agreement to the terms of the security agreement solely by clicking on an I Agree" button on a web page, but never physically signs the Security Agreement. Borrower and Lender agree to the terms of a security agreement containing a description of the collateral. Borrower signs the security agreement. Lender never makes a loan or issues a loan commitment. Borrower gives Lender permission to file a financing statement against its equipment, and Lender files a financing statement covering all equipment. Lender later make a loan to Borrower to finance the purchase of equipment. No security agreement is ever signed or authenticated Borrower and Lender negotiate the terms of a loan and a security agreement. The loan proceeds are to be used to purchase a new truck. The new truck is fully described in the security agreement, including its VIN number. The borrower receives the loan proceeds, but uses the proceeds to buy a different truck. Lender has an unsecured loan to Borrower. Borrower is unable to repay the loan, so Lender requires Borrower to pledge all of its assets. Borrower signs a security agreement in favor of Lender covering all of its assets in order to induce Lender not to file suit. Lender makes a loan to Borrower and as collateral takes possession of a stock certificate issued to Borrower covering 100,000 shares of Amazon stock. No security agreement is ever signed or authenticated. 1. In which of the following types of property could Craft Beer Co. (CBC) grant a security interest under UCC Article 9 to secure repayment of a term loan? Check the applicable boxes. May Company Grant an Article 9 Security Interest? Type of Property Yes No CBC's secret brewing process for an extremely hoppy IPA CBC's brewery (land + building) The malt sitting in CBC's tanks CBC's inventory of cans and bottles CBC's inventory of filled cans A painting of CBC's founder that hangs in the visitors' center All of CBC's brewing equipment CBC's bank account | CBC's right to a tax refund from the State of Colorado A promissory note payable to CBC from one of its founding shareholders 2. Has a valid security interest been created in the following situations? Check Yes or No. Be sure to explain your answer. Situation Yes No Explain Borrower and Lender agree to the terms of a security agreement, including a description of the collateral. Borrower indicates its agreement to the terms of the security agreement solely by clicking on an I Agree" button on a web page, but never physically signs the Security Agreement. Borrower and Lender agree to the terms of a security agreement containing a description of the collateral. Borrower signs the security agreement. Lender never makes a loan or issues a loan commitment. Borrower gives Lender permission to file a financing statement against its equipment, and Lender files a financing statement covering all equipment. Lender later make a loan to Borrower to finance the purchase of equipment. No security agreement is ever signed or authenticated Borrower and Lender negotiate the terms of a loan and a security agreement. The loan proceeds are to be used to purchase a new truck. The new truck is fully described in the security agreement, including its VIN number. The borrower receives the loan proceeds, but uses the proceeds to buy a different truck. Lender has an unsecured loan to Borrower. Borrower is unable to repay the loan, so Lender requires Borrower to pledge all of its assets. Borrower signs a security agreement in favor of Lender covering all of its assets in order to induce Lender not to file suit. Lender makes a loan to Borrower and as collateral takes possession of a stock certificate issued to Borrower covering 100,000 shares of Amazon stock. No security agreement is ever signed or authenticated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts