Question: If you could please show the work for them it would be greatly appreciated. In urgent ned for these answers. QUESTION 35 Assume you and

If you could please show the work for them it would be greatly appreciated. In urgent ned for these answers.

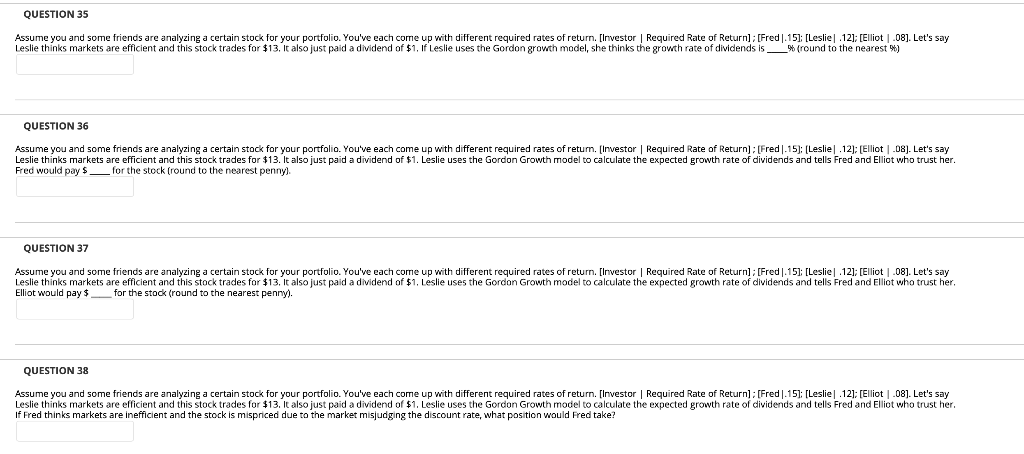

QUESTION 35 Assume you and some friends are analyzing a certain stock for your portfolio. You've each come up with different required rates of return. [Investor Required Rate of Return); [Fred|.151: [Leslie .12); [Elliot.08]. Let's say Leslie thinks markets are efficient and this stock trades for $13. It also just paid a dividend of $1. if Leslie uses the Gordon growth model, she thinks the growth rate of dividends is 9 (round to the nearest %) QUESTION 36 Assume you and some friends are analyzing a certain stock for your portfolio. You've each come up with different required rates of return. [Investor Required Rate of Return): [Fred.15) [Leslie .12); [Elliot -08]. Let's say Leslie thinks markets are efficient and this stock trades for $13. It also just paid a dividend of $1. Leslie uses the Gordon Growth model to calculate the expected growth rate of dividends and tells Fred and Elliot who trust her. Fred would pay $ for the stock (round to the nearest pennyl. QUESTION 37 Leslie thinks markets are efficient and this stock trades for $13. It also just paid a dividend of $1. Leslie uses the Gordon Growth model to calculate the expected growth rate of dividends and tells Fred and Elliot who trust her. : : Elliot would pay $ __ for the stock (round to the nearest penny). QUESTION 38 Assume you and some friends are analyzing a certain stock for your portfolio. You've each come up with different required rates of return. [Investor Required Rate of Return): [Fred |.151: [Leslie .12): [Elliot -08). Let's say Leslie thinks markets are efficient and this stock trades for $13. It also just paid a dividend of $1. Leslie uses the Gordon Growth model to calculate the expected growth rate of dividends and tells Fred and Elliot who trust her. If Fred thinks markets are inefficient and the stock is mispriced due to the market misjudging the discount rate, what position would Fred take? QUESTION 35 Assume you and some friends are analyzing a certain stock for your portfolio. You've each come up with different required rates of return. [Investor Required Rate of Return); [Fred|.151: [Leslie .12); [Elliot.08]. Let's say Leslie thinks markets are efficient and this stock trades for $13. It also just paid a dividend of $1. if Leslie uses the Gordon growth model, she thinks the growth rate of dividends is 9 (round to the nearest %) QUESTION 36 Assume you and some friends are analyzing a certain stock for your portfolio. You've each come up with different required rates of return. [Investor Required Rate of Return): [Fred.15) [Leslie .12); [Elliot -08]. Let's say Leslie thinks markets are efficient and this stock trades for $13. It also just paid a dividend of $1. Leslie uses the Gordon Growth model to calculate the expected growth rate of dividends and tells Fred and Elliot who trust her. Fred would pay $ for the stock (round to the nearest pennyl. QUESTION 37 Leslie thinks markets are efficient and this stock trades for $13. It also just paid a dividend of $1. Leslie uses the Gordon Growth model to calculate the expected growth rate of dividends and tells Fred and Elliot who trust her. : : Elliot would pay $ __ for the stock (round to the nearest penny). QUESTION 38 Assume you and some friends are analyzing a certain stock for your portfolio. You've each come up with different required rates of return. [Investor Required Rate of Return): [Fred |.151: [Leslie .12): [Elliot -08). Let's say Leslie thinks markets are efficient and this stock trades for $13. It also just paid a dividend of $1. Leslie uses the Gordon Growth model to calculate the expected growth rate of dividends and tells Fred and Elliot who trust her. If Fred thinks markets are inefficient and the stock is mispriced due to the market misjudging the discount rate, what position would Fred take

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts