Question: (ii). Newfoundland Vintners Co-operative is considering two mutually exclusive projects: Absinth and Brandy. Project Absinth requires a $20,500 cash outlay today and is expected

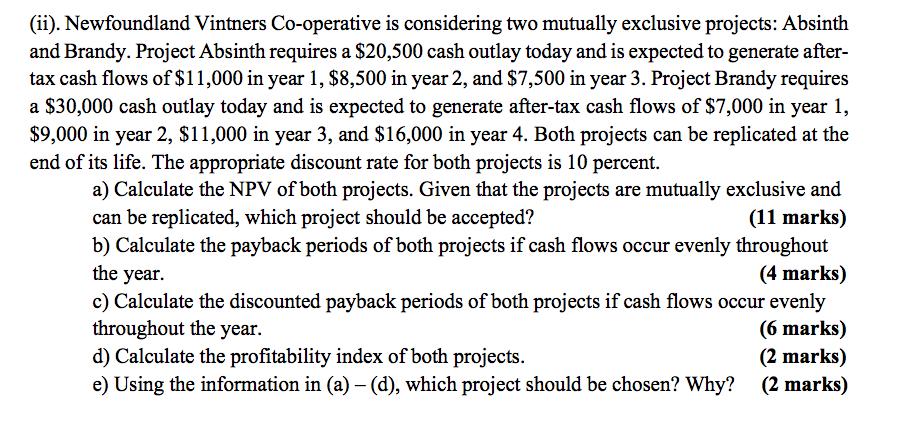

(ii). Newfoundland Vintners Co-operative is considering two mutually exclusive projects: Absinth and Brandy. Project Absinth requires a $20,500 cash outlay today and is expected to generate after- tax cash flows of $11,000 in year 1, $8,500 in year 2, and $7,500 in year 3. Project Brandy requires a $30,000 cash outlay today and is expected to generate after-tax cash flows of $7,000 in year 1, $9,000 in year 2, $11,000 in year 3, and $16,000 in year 4. Both projects can be replicated at the end of its life. The appropriate discount rate for both projects is 10 percent. a) Calculate the NPV of both projects. Given that the projects are mutually exclusive and can be replicated, which project should be accepted? (11 marks) b) Calculate the payback periods of both projects if cash flows occur evenly throughout the year. (4 marks) c) Calculate the discounted payback periods of both projects if cash flows occur evenly throughout the year. (6 marks) (2 marks) d) Calculate the profitability index of both projects. e) Using the information in (a) (d), which project should be chosen? Why? (2 marks)

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

A Net Present value project Brandy should be accept because NPV of Vrandy project great... View full answer

Get step-by-step solutions from verified subject matter experts