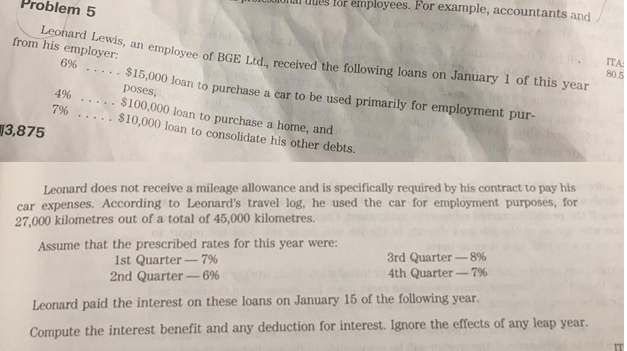

Question: ILI U or employees. For example, accountants and Problem 5 Leonard Lewis, an employee of BGE Ltd., received the from his employer: an employee of

ILI U or employees. For example, accountants and Problem 5 Leonard Lewis, an employee of BGE Ltd., received the from his employer: an employee of BGE Ltd., received the following loans on January 1 of this year loan to purchase a car to be used primarily for employment pur- poses, 4% . . . . . $100,000 loan to purchase a home, and 796 . . . . . $10,000 loan to consolidate his other debts. 6% ... ITA 805 13,875 Leonard does not receive a mileage allowance and is specifically required by his contract to pay his car expenses. According to Leonard's travel log, he used the car for employment purposes, for 27,000 kilometres out of a total of 45,000 kilometres. Assume that the prescribed rates for this year were: 1st Quarter -7% 3rd Quarter -8% 2nd Quarter -- 696 4th Quarter -- 796 Leonard paid the interest on these loans on January 15 of the following year. Compute the interest benefit and any deduction for interest. Ignore the effects of any leap year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts