Question: Illinois Tool Works Inc. - Operating Model ($ in Millions Except Per Share and Per Unit Data) INSTRUCTIONS: Use the following template and assumptions to

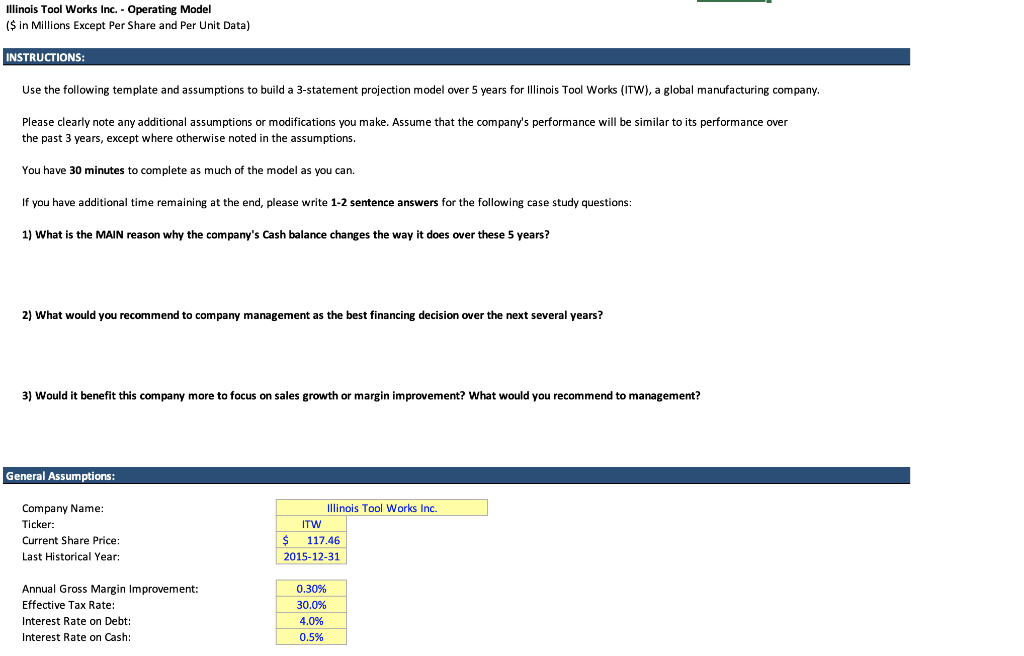

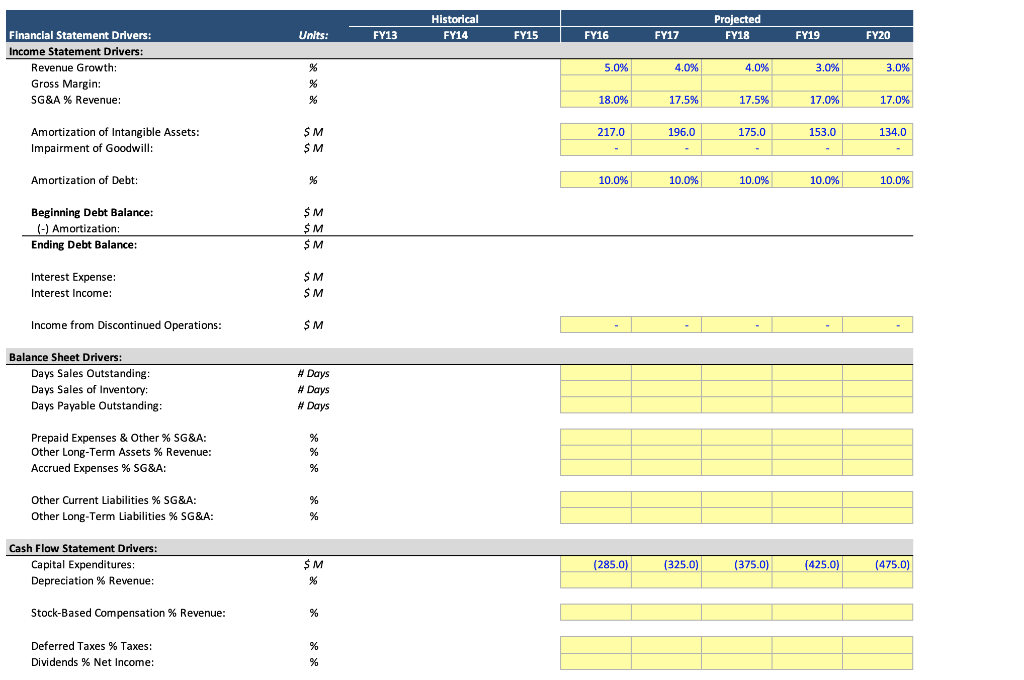

Illinois Tool Works Inc. - Operating Model (\$ in Millions Except Per Share and Per Unit Data) INSTRUCTIONS: Use the following template and assumptions to build a 3-statement projection model over 5 years for Illinois Tool Works (ITW), a global manufacturing company. Please clearly note any additional assumptions or modifications you make. Assume that the company's performance will be similar to its performance over the past 3 years, except where otherwise noted in the assumptions. You have 30 minutes to complete as much of the model as you can. If you have additional time remaining at the end, please write 1-2 sentence answers for the following case study questions: 1) What is the MAIN reason why the company's Cash balance changes the way it does over these 5 years? 2) What would you recommend to company management as the best financing decision over the next several years? 3) Would it benefit this company more to focus on sales growth or margin improvement? What would you recommend to management? Cash Flow Statement Drivers: Illinois Tool Works Inc. - Operating Model (\$ in Millions Except Per Share and Per Unit Data) INSTRUCTIONS: Use the following template and assumptions to build a 3-statement projection model over 5 years for Illinois Tool Works (ITW), a global manufacturing company. Please clearly note any additional assumptions or modifications you make. Assume that the company's performance will be similar to its performance over the past 3 years, except where otherwise noted in the assumptions. You have 30 minutes to complete as much of the model as you can. If you have additional time remaining at the end, please write 1-2 sentence answers for the following case study questions: 1) What is the MAIN reason why the company's Cash balance changes the way it does over these 5 years? 2) What would you recommend to company management as the best financing decision over the next several years? 3) Would it benefit this company more to focus on sales growth or margin improvement? What would you recommend to management? Cash Flow Statement Drivers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts