Question: im done with the question Question 21 1 points Save Answer Suppose that Mr. A is a derivative trader who invests $73,000 in 11-months call

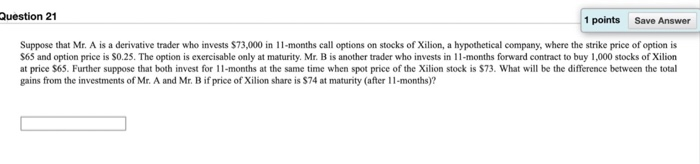

Question 21 1 points Save Answer Suppose that Mr. A is a derivative trader who invests $73,000 in 11-months call options on stocks of Xilion, a hypothetical company, where the strike price of option is $65 and option price is $0.25. The option is exercisable only at maturity. Mr. B is another trader who invests in 11-months forward contract to buy 1,000 stocks of Xilion at price $65. Further suppose that both invest for 11-months at the same time when spot price of the Xilion stock is $73. What will be the difference between the total gains from the investments of Mr. A and Mr. B if price of Xilion share is $74 at maturity (after 11-months)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts