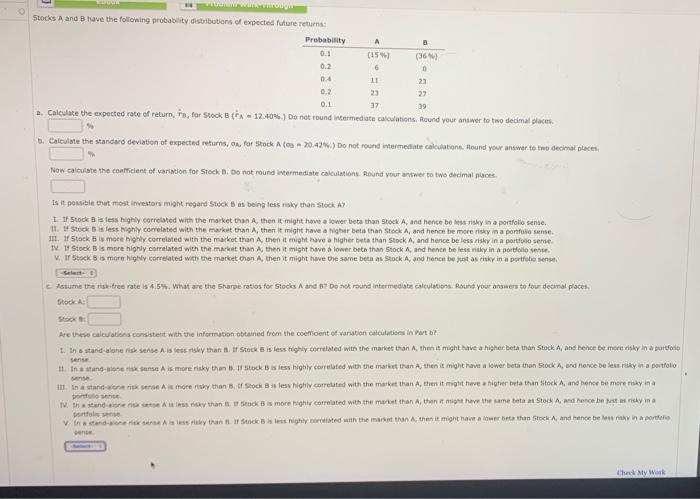

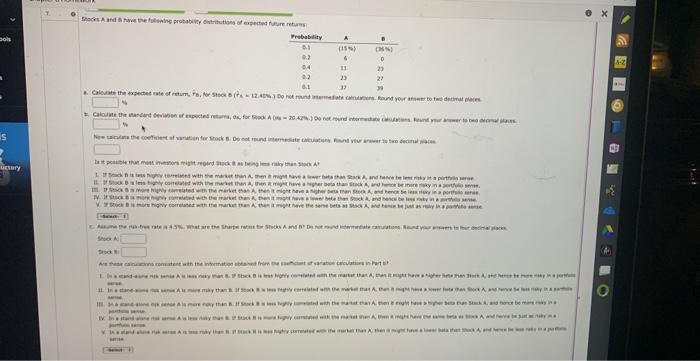

Question: im having a hard time figuring this one out Stocks A and B have the foltowing probablity distributiens of expected future returns:- a. Calculate the

Stocks A and B have the foltowing probablity distributiens of expected future returns:- a. Calculate the expected rate of return, rA, for 5 tock B(FA=12.40%. Do not round inkermediste calculations. Round your anayer to two dedimal slaces. 6. Calculate the standard deviation of expected returns, of, for 5 fock A (0020.42%.)Donotroundintermedatecalculations.Houndyouranswertotivodecimalplacen. Now calculate the coefficient of variation for 5tock B. Do not round intermediate calculations. Ahound your answer to two cecimal nisoes. Is it possible thut most investors might regard 5 tock B as being less fisky than stock A? I. If 5 tock A is less highy corretsed with the market than A, then it might howe a wower beta than 5 toek A, and hence be kess rishy in a portfolio sense. 13. If Stock 8 is less Nighly cocrelated with the market tran A, then it might have a higher beta than stock A, and hence be more risky in a pontulo sense. 17.. If 5 tock 8 is more Bighir correisted with the maket than A, then it might have a higher beta than stock A, and hence be less riskr in a portfole serrie. TV. If Stock B is more highly correlated with the market tran A, then it might hwe a lower beta than Stock A, and hence be less rithy in a portfoilo seris. V. If 5 sock 8 is mare highly correlated with the market than A, then it might heve the same beta as sock A. and hance be just as risky in a porifilis sense. C. Assume the tisk-tree rate is 4.5%. What are the Sharpe ratios for stocks A and 87 Do not raund intermediate caliculetions. Round your answess to tour decanal place. Stack a 4 wense. unse: bonthese serise sente tente

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts