Question: I'm having great trouble understanding it. Please explain how you got the answer for each one. Recording sales made with bank credit cards and American

I'm having great trouble understanding it. Please explain how you got the answer for each one.

Recording sales made with bank credit cards and American Express, with 8 percent sales tax.

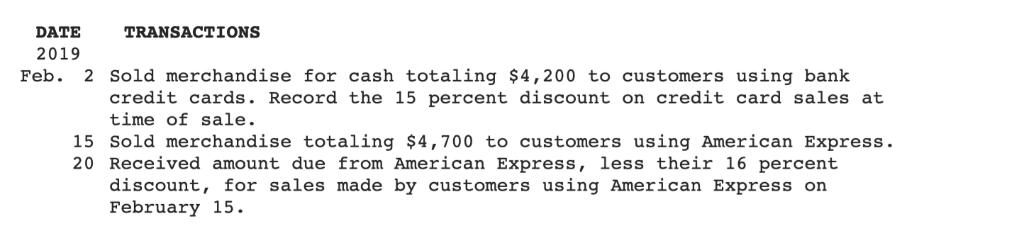

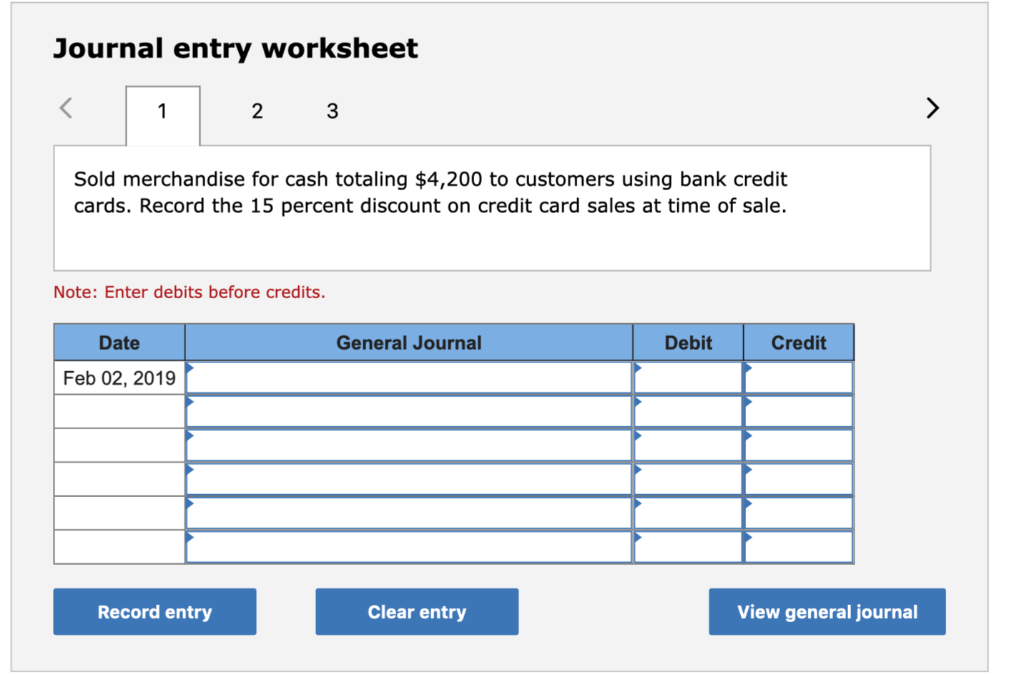

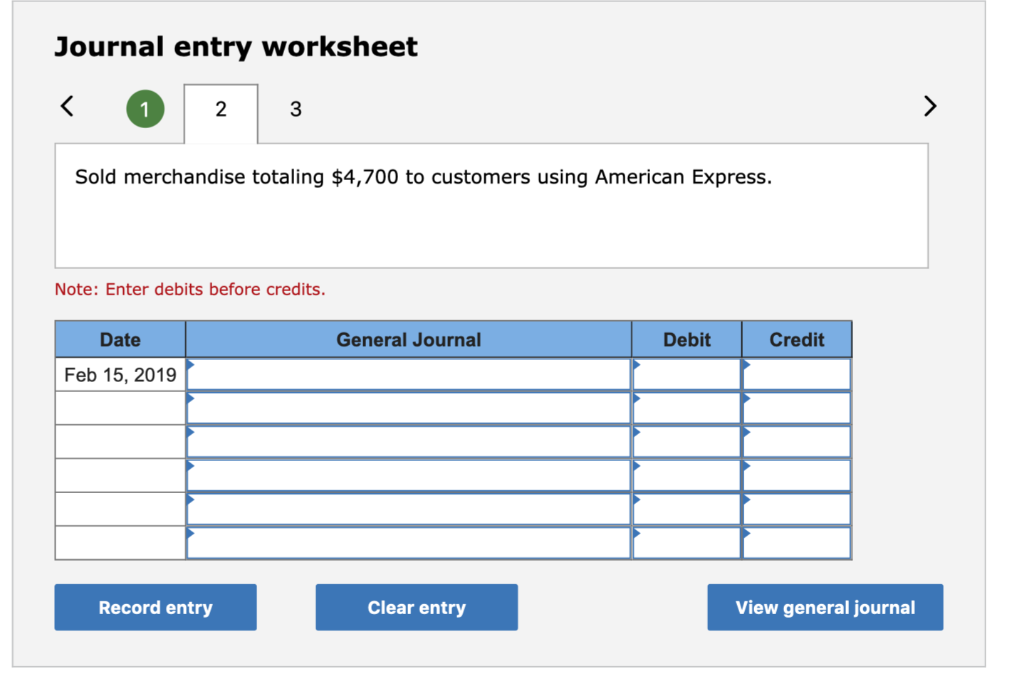

DATE TRANSACTI ONS 2019 Feb 2 Sold merchandise for cash totaling $4,200 to customers using bank credit cards. Record the 15 percent discount on credit card sales at time of sale. 15 Sold merchandise totaling $4,700 to customers using American Express. 20 Received amount due from American Express, less their 16 percent discount, for sales made by customers using American Express on February 15. Journal entry worksheet 1 2 3 Sold merchandise for cash totaling $4,200 to customers using bank credit cards. Record the 15 percent discount on credit card sales at time of sale. Note: Enter debits before credits. Date General Journal Debit Credit Feb 02, 2019 Record entry Clear entry View general journal Journal entry worksheet 2 3 Sold merchandise totaling $4,700 to customers using American Express. Note: Enter debits before credits Date General Journal Debit Credit Feb 15, 2019 Record entry Clear entry View general journal Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts