Question: I'm looking for a different answer to that which is on chegg. Thanks Robert 3 2. Carling Ltd is a manufacturer of industrial drills. It

I'm looking for a different answer to that which is on chegg. Thanks Robert

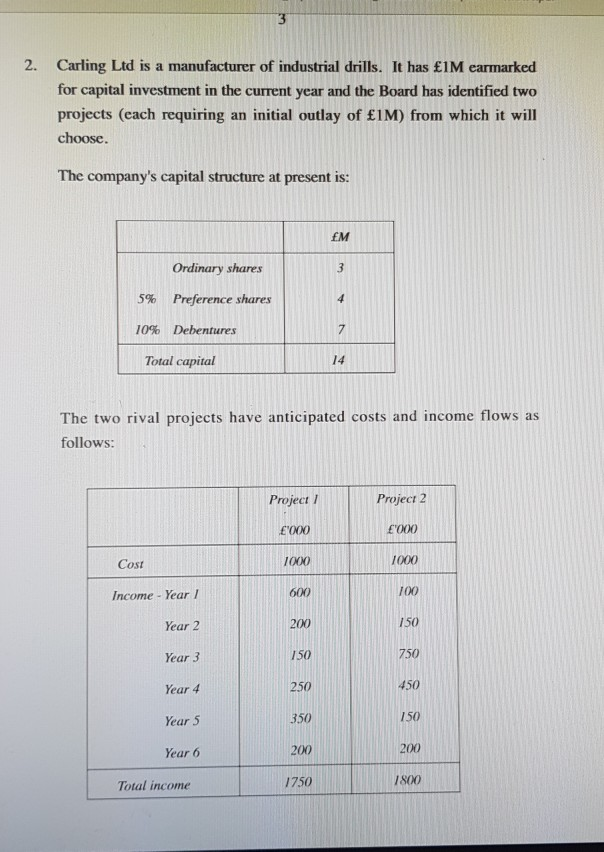

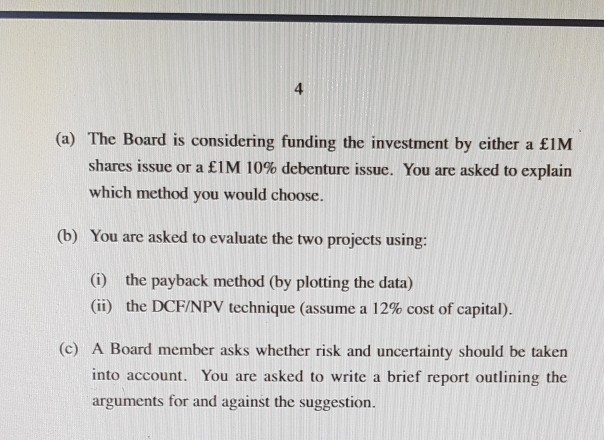

3 2. Carling Ltd is a manufacturer of industrial drills. It has E1M earmarked for capital investment in the current year and the Board has identified two projects (each requiring an initial outlay of 1M) from which it will choose The company's capital structure at present is: EM Ordinary shares 5% Preference shares 10% Debentures Total capital 14 The two rival projects have anticipated costs and income flows as Project 2 Project 1 000 1000 600 000 1000 10o 150 750 450 150 200 1800 Cost Income - Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 200 150 250 350 200 1750 Total income 4 (a) The Board is considering funding the investment by either a IM shares issue or a 1 M 10% debenture issue. You are asked to explain which method you would choose. You are asked to evaluate the two projects using: i) the payback method (by plotting the data) (b) (ii) the DCF/NPV technique (assume a 12% cost of capital). (c) A Board member asks whether risk and uncertainty should be taken into account. You are asked to write a brief report outlining the arguments for and against the suggestion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts