Question: I'm stuck on how to answer this question from my Diploma in Finance and Mortgage Broking course 6. Describe how you would present lender options

I'm stuck on how to answer this question from my Diploma in Finance and Mortgage Broking course

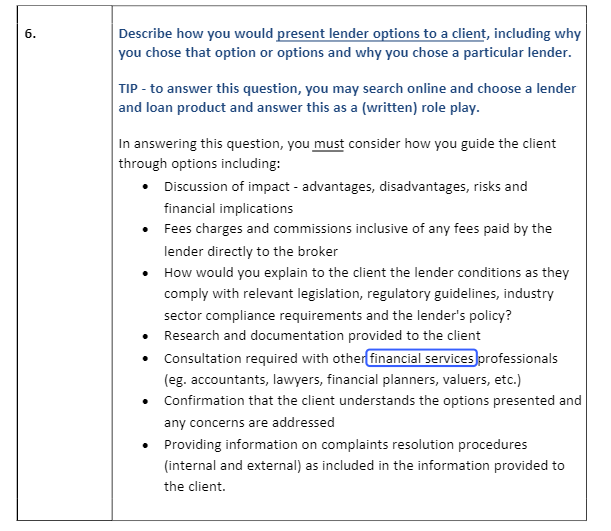

6. Describe how you would present lender options to a client, including why you chose that option or options and why you chose a particular lender. TIP - to answer this question, you may search online and choose a lender and loan product and answer this as a (written) role play. In answering this question, you must consider how you guide the client through options including: Discussion of impact - advantages, disadvantages, risks and financial implications Fees charges and commissions inclusive of any fees paid by the lender directly to the broker How would you explain to the client the lender conditions as they comply with relevant legislation, regulatory guidelines, industry sector compliance requirements and the lender's policy? Research and documentation provided to the client Consultation required with other financial services professionals (eg. accountants, lawyers, financial planners, valuers, etc.) Confirmation that the client understands the options presented and any concerns are addressed Providing information on complaints resolution procedures (internal and external) as included in the information provided to the client.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts