Question: Q.5 Shadman Enterprises Limited (SEL) produces two products, namely A and B. The following figures have been extracted from the draft profit and loss

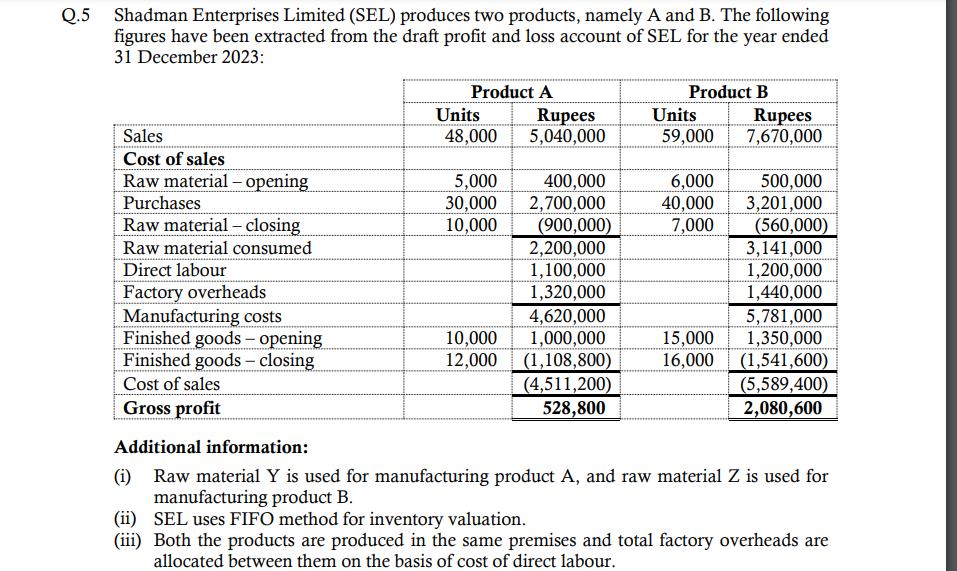

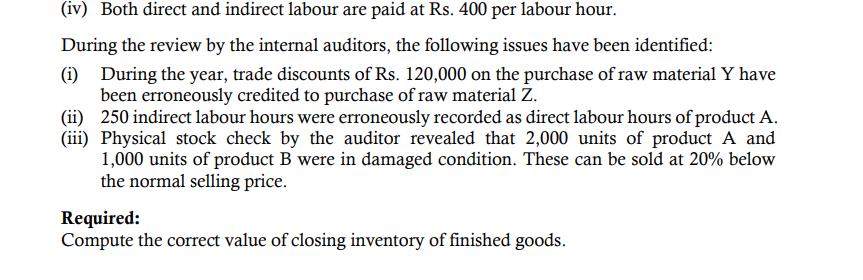

Q.5 Shadman Enterprises Limited (SEL) produces two products, namely A and B. The following figures have been extracted from the draft profit and loss account of SEL for the year ended 31 December 2023: Product A Product B Units Sales 48,000 Rupees 5,040,000 Units Rupees 59,000 7,670,000 Cost of sales Raw material-opening 5,000 400,000 6,000 500,000 Purchases 30,000 2,700,000 40,000 3,201,000 Raw material- closing 10,000 (900,000) 7,000 (560,000) Raw material consumed 2,200,000 3,141,000 Direct labour 1,100,000 1,200,000 Factory overheads 1,320,000 1,440,000 Manufacturing costs 4,620,000 5,781,000 Finished goods - opening 10,000 1,000,000 15,000 1,350,000 Finished goods - closing 12,000 (1,108,800) 16,000 (1,541,600) Cost of sales (4,511,200) (5,589,400) Gross profit 528,800 2,080,600 Additional information: (i) Raw material Y is used for manufacturing product A, and raw material Z is used for manufacturing product B. (ii) SEL uses FIFO method for inventory valuation. (iii) Both the products are produced in the same premises and total factory overheads are allocated between them on the basis of cost of direct labour. (iv) Both direct and indirect labour are paid at Rs. 400 per labour hour. During the review by the internal auditors, the following issues have been identified: (i) During the year, trade discounts of Rs. 120,000 on the purchase of raw material Y have been erroneously credited to purchase of raw material Z. (ii) 250 indirect labour hours were erroneously recorded as direct labour hours of product A. (iii) Physical stock check by the auditor revealed that 2,000 units of product A and 1,000 units of product B were in damaged condition. These can be sold at 20% below the normal selling price. Required: Compute the correct value of closing inventory of finished goods.

Step by Step Solution

There are 3 Steps involved in it

To analyze the information provided and determine the cost of raw materials consumed for products A and B as well as the allocation of factory overheads we need to perform some calculations based on t... View full answer

Get step-by-step solutions from verified subject matter experts