Question: SENSITIVITY ANALYSIS UNIT SALES SUMMARY % Deviation Number from base of unit NPV IRR case sales % Deviation NPV IRR from base case 20% 1.500

SENSITIVITY ANALYSIS UNIT SALES SUMMARY % Deviation Number from base of unit NPV IRR case sales % Deviation NPV IRR from base case 20% 1.500 $

SENSITIVITY ANALYSIS

UNIT SALES

SUMMARY

% Deviation Number

from base

of unit

NPV

IRR

case

sales

% Deviation

NPV

IRR

from base case

20%

1,500 $119,420.02

16.84%

Units

Variable

WACC

Units

Variable

WACC

0%

1,250 $ 13,012.29

7.27%

sales

Costs

sold

Costs

-20%

1.000 $ (93.395.44)

-4.04%

20% $ 119,420.02 $ (52,278.80) S

198.98

16.84%

0.73%%

7.22%

0% $ 13,012.29 $

13,012.29 $13.012.29

7.27%

7.27%

7.27%

-20% $ (93,395.44) $ 78,303.37 $26,709.18

4.04%

13.48%

7.33%

VARIABLE COSTS

% Deviation

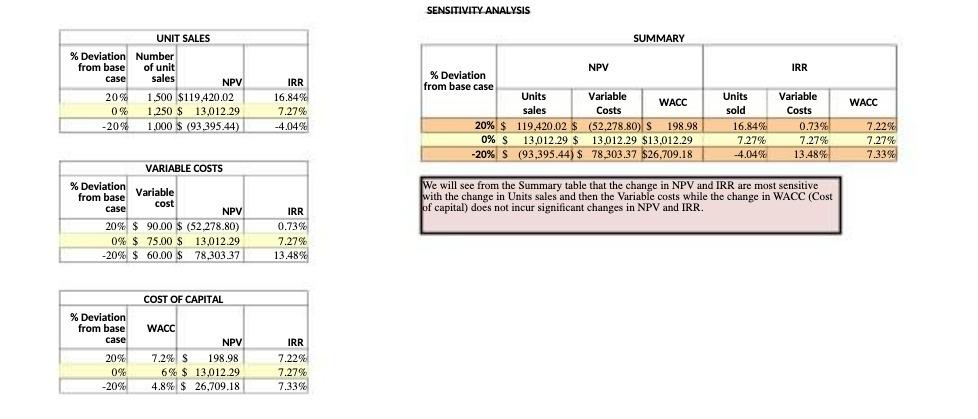

We will see from the Summary table that the change in NPV and IRR are most sensitive

from base

Variable

with the change in Units sales and then the Variable costs while the change in WACC (Cost

cost

case

NPV

IRR

of capital) does not incur significant changes in NPV and IRR.

20% $ 90.00 $ (52,278.80)

0.73%

0% $ 75.00 $ 13,012.29

7.27%

-20% $ 60.00 $ 78,303.37

13.48%

COST OF CAPITAL

% Deviation

from base

WACC

case

NPV

IRR

20%

7.2% S

198.98

7.22%

0%

6% $ 13,012.29

7.27%

-20% 4.8% $ 26,709.18

7.33%

Additional comments: Formula for these?

SENSITIVITY ANALYSIS UNIT SALES % Deviation Number from base case SUMMARY of unit NPV IRR sales NPV IRR % Deviation from base case 20% 1,500 $119,420.02 16.84% 0% 1,250 $ 13,012.29 7.27% Units sales -20% 1,000 $ (93,395.44) -4.04% Variable Costs 20% $ 119,420.02 $ (52,278.80) S 198.98 0% $ 13,012.29 $ 13.012.29 $13,012.29 -20% S (93,395.44) $ 78,303.37 $26,709.18 Units Variable WACC WACC sold Costs 16.84% 0.73% 7.22% 7.27% 7.27% 7.27% -4.04% 13.48% 7.33% VARIABLE COSTS % Deviation from base Variable cost case NPV IRR 0.73% 7.27% 13.48% 20% $90.00 $ (52,278.80) 0% $ 75.00 $ 13,012.29 -20% $ 60.00 $ 78,303.37 COST OF CAPITAL % Deviation from base WACC case NPV IRR 20% 7.2% S 198.98 7.22% 0% 6% $ 13,012.29 7.27% -20% 4.8% $ 26,709.18 7.33% We will see from the Summary table that the change in NPV and IRR are most sensitive with the change in Units sales and then the Variable costs while the change in WACC (Cost of capital) does not incur significant changes in NPV and IRR.

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Based on the information provided in the sources regarding sensitivity analysis in managerial accounting we can address the questions related to the scenarios outlined in the summary table Scenario 1 ... View full answer

Get step-by-step solutions from verified subject matter experts