Question: Implied Real Interest Rates. Use the table containing economic, financial, and business indicators to answer the following questions. If the nominal interest rate is the

Implied Real Interest Rates. Use the table

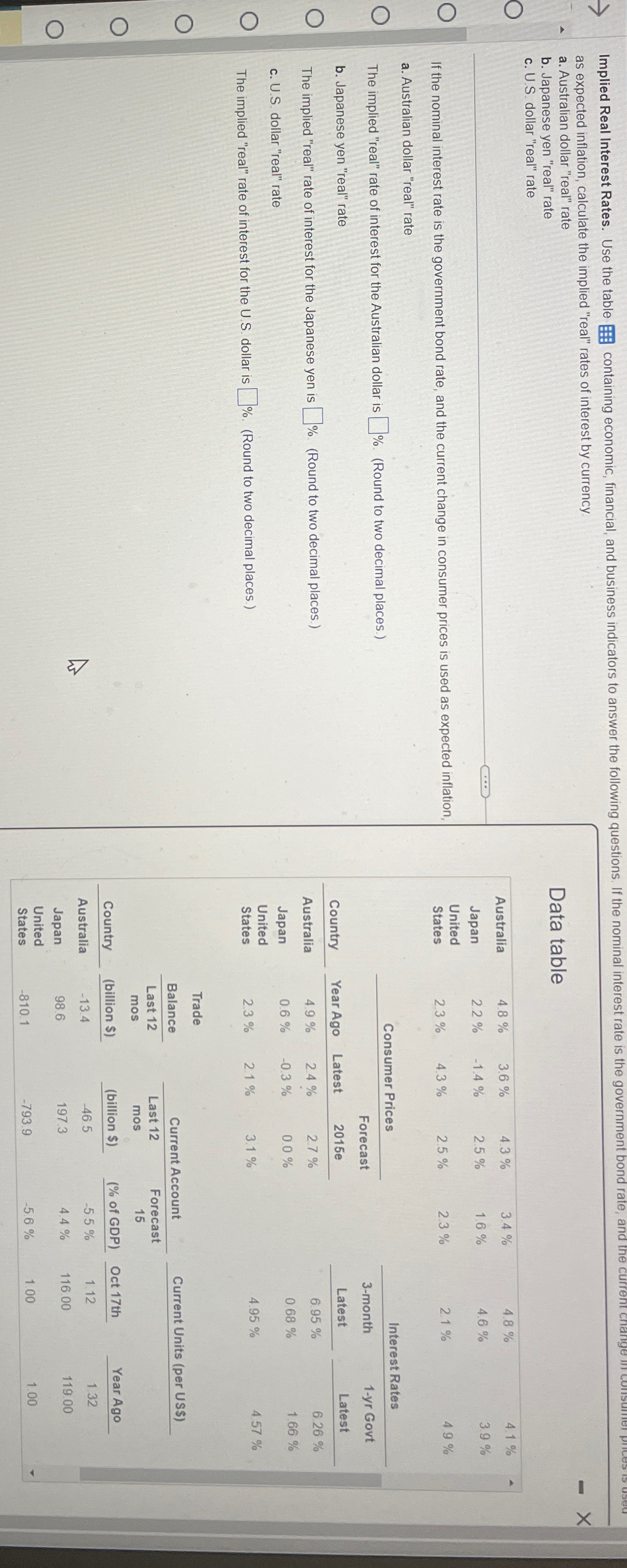

containing economic, financial, and business indicators to answer the following questions. If the nominal interest rate is the government bond rate, and the current crange in

as expected inflation, calculate the implied "real" rates of interest by currency.

a Australian dollar "real" rate

b Japanese yen "real" rate

c US dollar "real" rate

If the nominal interest rate is the government bond rate, and the current change in consumer prices is used as expected inflation,

a Australian dollar "real" rate

The implied "real" rate of interest for the Australian dollar is Round to two decimal places.

b Japanese yen "real" rate

The implied "real" rate of interest for the Japanese yen is Round to two decimal places.

c US dollar "real" rate

The implied "real" rate of interest for the US dollar is Round to two decimal places.

Data table

tableAustralia

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock