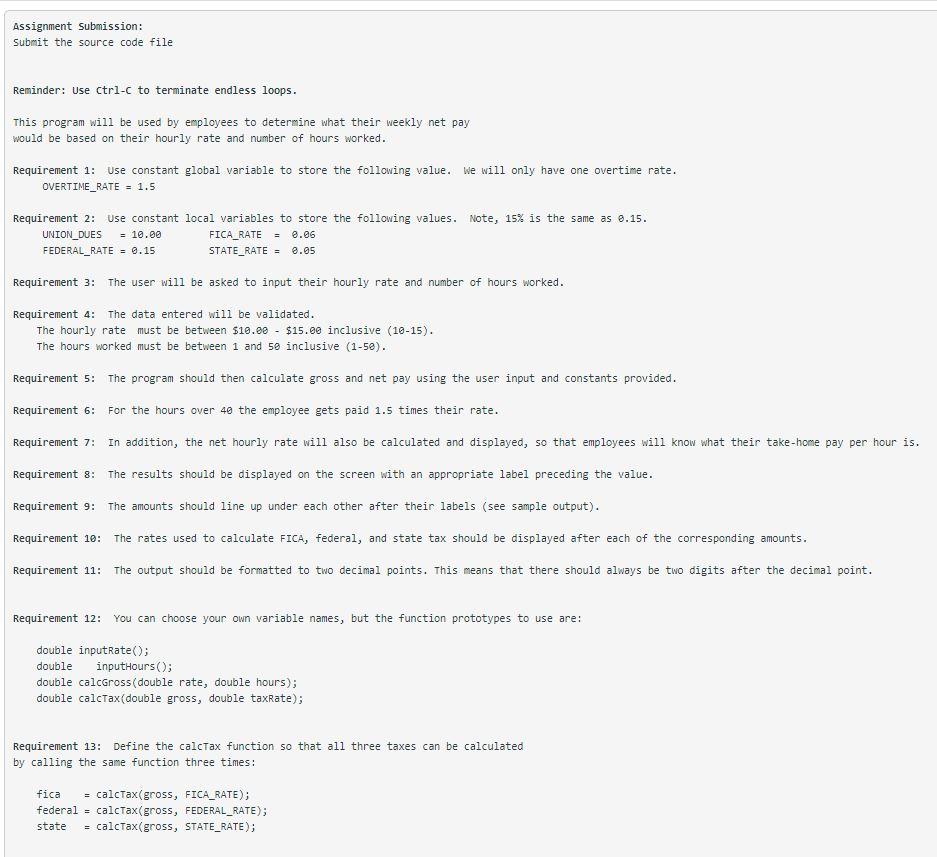

Question: IN C++ USE A FUNCTION to get the payrate, hours, to calculate gross pay, and to calculate the three taxes. For the taxes, define one

IN C++ USE A FUNCTION to get the payrate, hours, to calculate gross pay, and to calculate the three taxes. For the taxes, define one function that is called three different times with different arguments. Use Pseudocode as formatPseudocode: //function prototypes double inputRate(); double inputHours(); double calcGross(double rate, double hours); double calcTax(double gross, double taxRate); int main() { cout 40) { gross = gross pay including overtime } else { gross = gross pay excluding overtime } return gross; } double calcTax(double gross, double taxRate) { double amount; amount = gross * taxRate; return amount; }

Use these cases to test your program: Case # Rate Worked Case # Rate worked 1 12.50 40 2 15.00 45 Sample output: Pes - Your Name Enter a value between $10 and $15.00 for the hourly rate: 12.50 Enter a value between 1 and 5e for the hours worked: 49 12.50 40 Hourly Rate: Hours worked: Gross Pay: FICA Tax : Federal Tax: State Tax: Union Dues: Net pay: Net Hourly: 500.00 30.00 at 0.06 75.00 at 0.15 25.00 at 9.85 10.00 360.00 9.ee Thank you! Press any key to continue P95 - Your Name Enter a value between $10 and $15.00 for the hourly rate: 15 Enter a value between 1 and 5e for the hours worked: 45 Hourly Rate: Hours Worked: Gross Pay: FICA Tax: Federal Tax: State Tax: Union Dues: Net pay: Net Hourly: 15.00 45 712.50 42.75 at 0.06 126.88 at 8.15 35.63 at 0.85 18.00 517.25 11.49 Thank you! Press any key to continue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts