Question: IN EXCEL, SHOW ME THE FORMULAS PLEASE. Please be thorough, I am very confused by this problem and need to learn it for a test.

IN EXCEL, SHOW ME THE FORMULAS PLEASE. Please be thorough, I am very confused by this problem and need to learn it for a test. NPV or PV functions must be used in Excel. Your explanations are also required to describe each one. Please show me the formulas so I know how to practice.

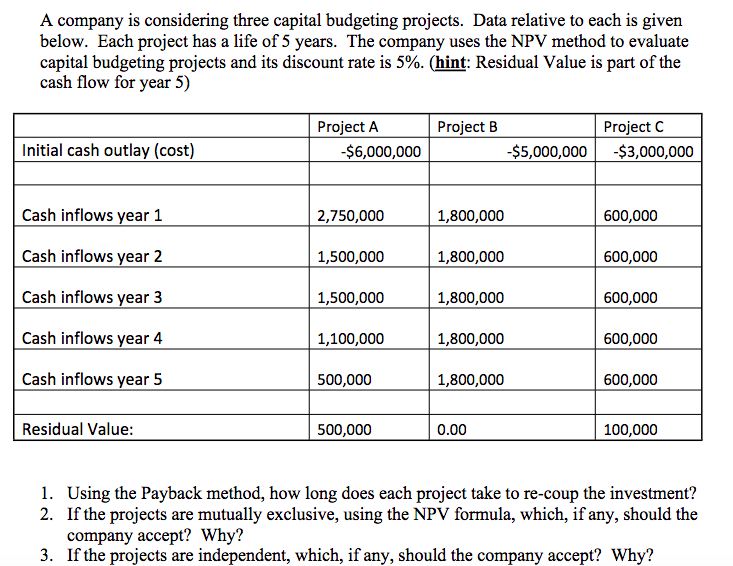

A company is considering three capital budgeting projects. Data relative to each is given below. Each project has a life of 5 years. The company uses the NPV method to evaluate capital budgeting projects and its discount rate is 5%. (hint: Residual Value is part of the cash flow for year 5) Initial cash outlay (cost) Project A Project B $6,000,000 $5,000,000 Project C -$3,000,000 Cash inflows year 1 2,750,000 1,800,000 600,000 Cash inflows year 2 1,500,000 1,800,000 600,000 Cash inflows year 3 1,500,000 1,800,000 600,000 Cash inflows year 4 1,100,000 1,800,000 600,000 Cash inflows year 5 500,000 1,800,000 600,000 Residual Value: 500,000 0.00 100,000 1. Using the Payback method, how long does each project take to re-coup the investment? 2. If the projects are mutually exclusive, using the NPV formula, which, if any, should the company accept? Why? 3. If the projects are independent, which, if any, should the company accept? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts